Is Amazon’s Rise Over? The 12-Year Chart Indicates it may only be Temporary

(Reuters) – Amazon.com Inc may be a “buy” for the vast majority of analysts, but it was a “sell” for a lot of investors on Friday.

The trigger for the profit-taking was the company’s statement on Thursday that its operating income for the holiday shopping quarter would range from nothing to $1.25 billion, due to heavy investment across its businesses.

Analysts had expected operating income of $1.62 billion for the period, according to research firm Fact Set, but few of them expressed any concern about Amazon’s prospects on Friday.

“Shares tend to underperform over the near-term, but each of these phases has presented a great buying opportunity for long-term investors,” Deutsche Bank analysts wrote in a note.

Of the 46 analysts covering Amazon, 41 have a “buy” or higher rating on the stock, according to Thomson Reuters data.

The strong performance of the company’s cloud services business, Amazon Web Services, also bodes well for the future, analysts said, with Deutsche Bank saying it “represented the most important piece of the bull case.”

Revenue generated by Amazon’s market-leading cloud business jumped 55 percent to $3.23 billion in the quarter ended Sept. 30, accounting for about 10 percent of overall revenue.

“While weaker-than-expected margin guidance will spook some investors, we remain firm believers in the long-term story of growing revs and margins,” Macquarie Research analysts wrote in a client note, while maintaining their “outperform” rating.

“The bottom line is that given the stock’s run and fears of near-term margin pressure, investors are likely to take profits,” the analysts said.

Goldman Sachs analysts, who have a “buy” rating on Amazon, said that while investments would weigh on margins in the near term, “we believe the payoff of these investments will create considerable growth and value for AMZN shareholders.”

Amazon, which went public in 1997, has made a profit for the past six quarters. Previously, the company had only occasional profitable quarters as Chief Executive Jeff Bezos focused on building the business rather than on short-term results.

Goldman Sachs, Deutsche Bank and RBC cut the price targets on the stock, citing valuation, but kept their top ratings. Canaccord Genuity and Susquehanna raised their targets.

Analysts noted that most of the margin pressure on Amazon was due to its heavy spending to build warehouses, or fulfillment centers, that will help speed up deliveries – a strategy they said would pay off handsomely in future quarters.

“As momentum builds up in all businesses, AMZN keeps investing to support that growth,” Jefferies analysts said, while noting that some of these investments are “lumpy” and can take a couple of quarters to reach optimal efficiency.

“Our long-standing thesis remains intact as AMZN increases investment in the assets (fulfillment, digital content, AWS) that reinforce its competitive moats,” the analysts said.

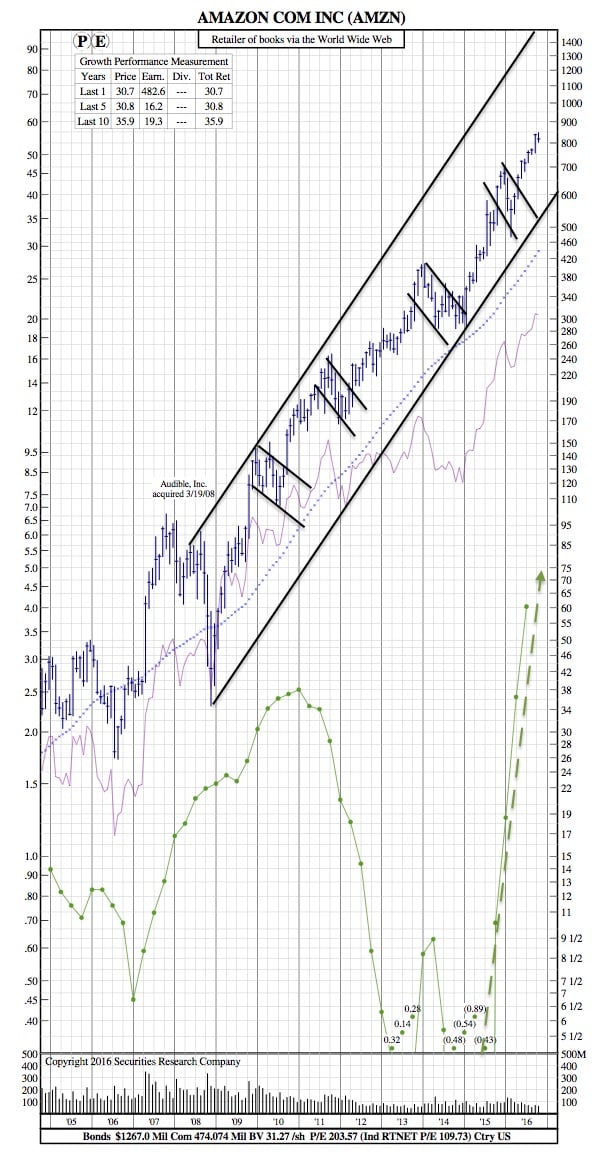

12-Year Chart:

Aside from the obvious uptrend in both earnings and price, it is remarkable that in the last 7 years, Amazon’s price has followed a similar pattern at least 4 times. As illustrated in the chart, after a strong price rally, a relatively brief selloff occurs before the climb resumes again. Looking at the most current data and assuming the pattern holds true, Amazon may be due for another selloff.