Growth Stocks

Growth stocks show steadily rising earnings which have been reflected in higher stock market prices and a greater market evaluation of earnings. It also shows that the performance has consistently been better than the market generally. Along with rising profits, dividends have been increased almost annually. On the other hand, the record is not a straight upward line, for even the most outstanding companies are subject to some extent to the business cycles and market fluctuations.

Investors looking for growth stocks are concerned with a company’s future growth potential, but there is no absolute formula for evaluating this potential. Every method of picking growth stocks (or any other type of stock) requires some individual interpretation and judgment. Growth stock investors use certain methods – or sets of guidelines or criteria – as a framework for their analysis, but these methods must be applied with a company’s situation in mind. More specifically, the investor must consider the company in relation to its past performance and its industry’s performance. The application of any one guideline or criterion may therefore change from company to company and from industry to industry.

- Return on Equity >= 20%

- P/E to Earnings Growth <= .5

- Earnings Growth (1yr.) >=25%

- Revenue Growth (1yr.) >=25%

- Market Capitalization < 5 Billion (Mid or Small)

- Dividend Yield >= 2.5%

Price Growth

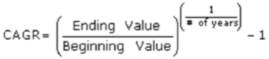

By clicking on the Price Growth Filter you will be presented the option of selecting a range from 1 year, 5 years, or 10 years. You may then proceed to make a selection from more than or equal to, less than or equal to, or a range consisting of the two. Your selections may be a value less than 0. When choosing a range be sure that your more than or equal to value is not more than your less than or equal to value. The Price Growth value will be displayed with the selection of companies returned. Calculation of the price growth percent is derived using the last close price and the corresponding month end value for the current value being calculated in the time period of your selection. These values are then used to calculate the compound annual growth rate (CAGR) which is then multiplied by 100 to create a percent value.