Dividend Stocks

Dividend & Dividend Stocks.

A dividend is a payment made to shareholders of a stock which comes from the company’s profits as a reward or benefit from investing in a company. Most of the profits that a company makes is used to fund the company’s current and future activities, such as product development, sales growth, operational expansion and other activities.

Dividend growth can give the investor a very good idea of how the company is performing. Questions include, are they growing? Is there consistency to the payments? How does dividend growth compare to price and earnings growth?

Dividends stocks are also called “income stocks”.

Relative to the overall market, such stocks have portions of profits that are paid out to investors. Dividend stocks are generally less vulnerable to cyclical changes than other groups, though they may be importantly affected by money rate fluctuations.

Investing in dividend stocks is about more than stock screening to find companies with the highest dividend yield. Because these yields are only worth something if they are sustainable, dividend stock investors must be sure to analyze their companies carefully, buying only ones that have good fundamentals. Like all other investing strategies, the dividend stock investing has no set formula for finding a good company. To determine the sustainability of dividends by means of fundamental analysis, each individual investor must use his or her own interpretive skills and personal judgment – for this reason, we don’t get into what defines a “good company”. With the right research, you can find and invest in dividend stocks that have good earnings and price growth.

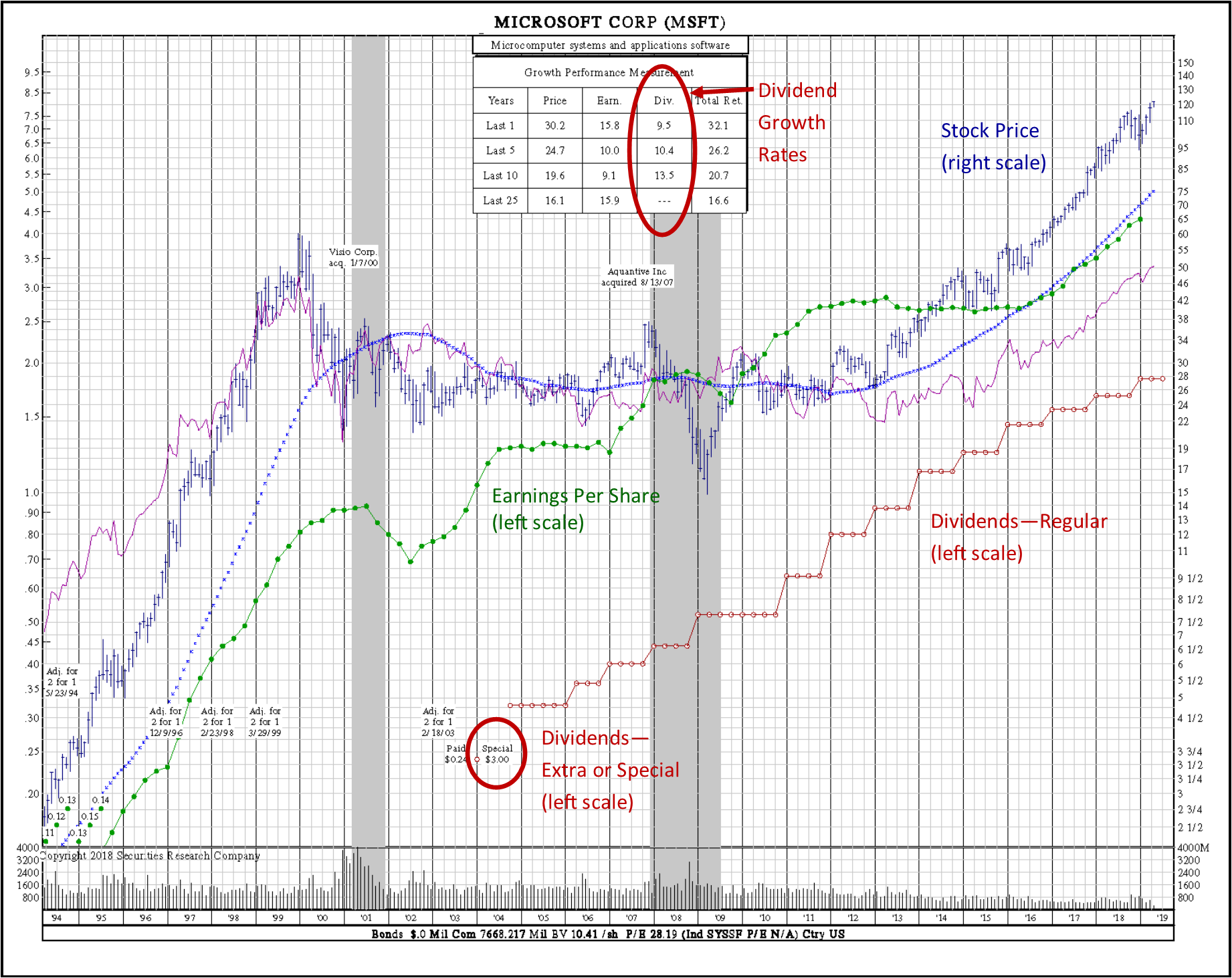

In this section, we will explore two types of dividends and examples, as well as touching on dividend investing or what is also called income investing. Let’s first look at the Microsoft 25-Year stockchart below.

In the Microsoft stock chart above, there are three points to be made.

The first is the special or extra dividend that the board of directors paid in 2004 (noted on chart). And Microsoft began to make regular dividend payments shortly thereafter.

The dividend growth rates for Microsoft using the Compound Average Growth Rate (CAGR) formula. The CAGR for Microsoft is 9.5% for the past year; 10.4% for the past five years; and 15.5% for the past 10 years.

Dividend Stocks – Using ChartScreen to find the right stocks.

SRC’s ChartScreen stock research system provides filters that allow you to screen for dividend stocks that match your investing criteria. For our purposes, here’s an example of criteria for helping to find the right dividend stocks to consider:

- Return on Equity >= 10%

- Dividend Yield >= 2.5%

- Price to Free Cash Flow <= 10

- R2 (Earnings Stability) >= 80

- Dividend Growth Rate (10-Years) >=10%

- Earnings Growth Rate (10-Years) >=10%

By increasing or decreasing these filters, narrower or broader results are returned. We will take a look at one company stock that meets the above requirements,

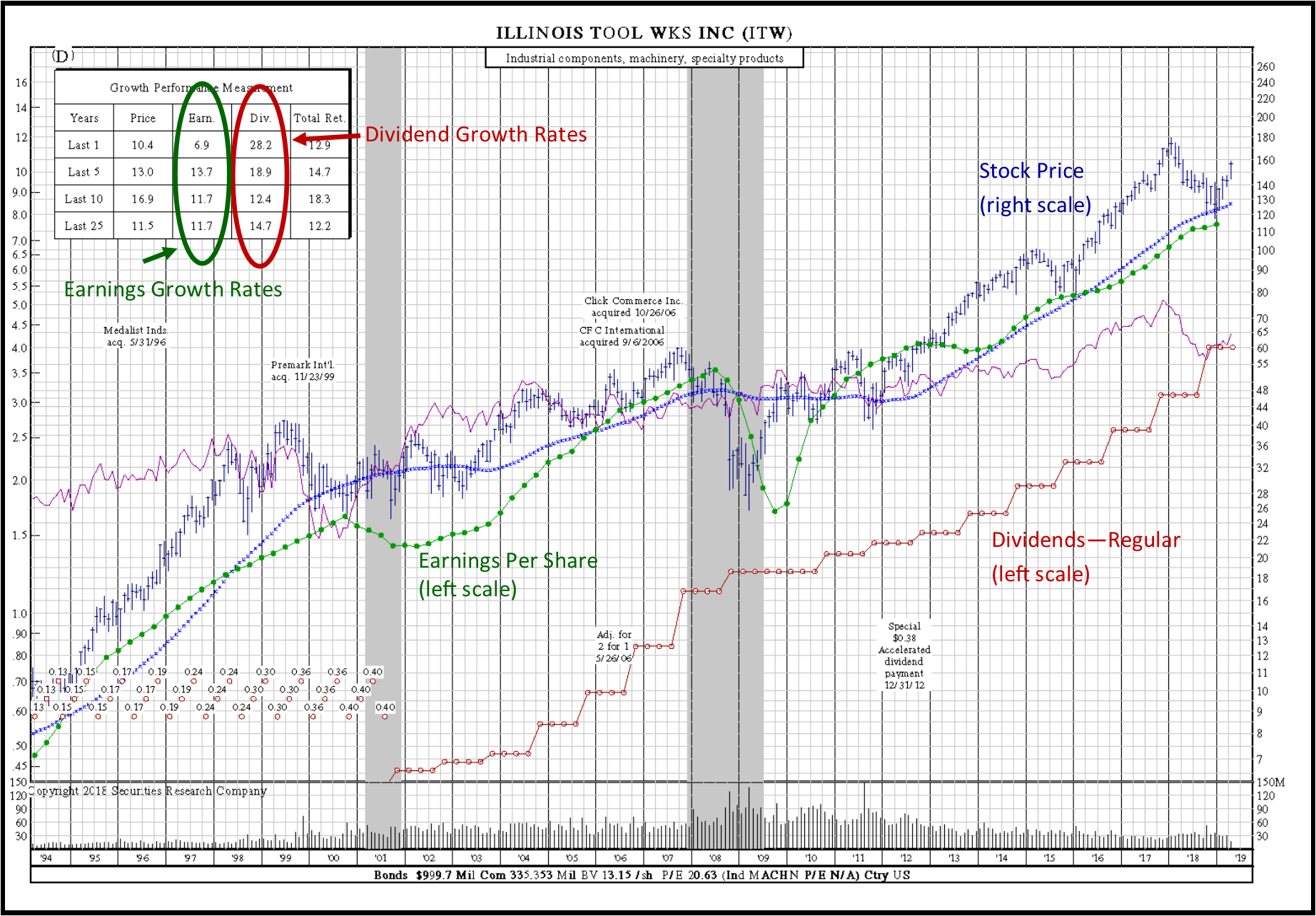

Let’s look at the stockchart for Illinois Tool Works (ITW) stockchart below, as this was one of the company’s returned using the search criteria above.

For Illinois Tool Works (ITW), the data results are below:

- Return on Equity = 41.9

- Dividend Yield = 2.53%

- R2 (Earnings Stability) = 90

- Dividend Growth Rate (10-Years) = 12.4%

- Earnings Growth Rate (10-Years) = 11.6%