Google parent Alphabet Beats on Revenue, Earnings; sets Buyback (12-Year Chart Inside)

Alphabet reported quarterly earnings that topped analysts’ estimates and revenue that beat expectations on Monday, and announced a more than $7 billion stock buyback authorized this month.

Google’s parent company posted third-quarter earnings per share of $9.06, adjusted, on revenue of $22.45 billion. The technology titan was expected to report fiscal third-quarter earnings of $8.63 a share on revenue of $22.05 billion, according to a Thomson Reuters consensus estimate.

That’s up against the comparable year-ago figure $7.35 a share, with revenue up 20 percent from last year’s $18.68 billion.

The company also approved a stock repurchase up to $7B of its Class C shares. This quarter last year, the company repurchased $5B of its Class C capital stock.

“I think that the buyback outlook is important. People are looking for more balanced return profile out of Google now: a little bit of growth, a little bit of margin, and a little bit of capital return. So I think it all makes sense,” Michael Graham, senior internet analyst at Canaccord Genuity, told CNBC’s “Closing Bell” on Thursday.

Google’s websites saw sales increase 23 percent to $16.09 billion, above the $15.79 expected by a StreetAccount consensus estimate, while advertising revenues rose 18 percent to $19.82 billion.

Total traffic acquisitions costs were 21 percent of revenues, the same as this quarter last year.

Traffic acquisition costs to Google Network Members rose to $2.62 billion, 70 percent of revenues from Google Network Members. Meanwhile TAC to distribution partners rose to $1.56 billion, 10 percent of Google website revenues.

During the quarter, Google’s revenues rose to $22.25 billion, while “other bets” revenue rose to $197 million, thanks to Nest, Fiber and Verily, Porat said.

Google is second only to Facebook when it comes to 2016 display ad revenue worldwide, and is the leader of search ad spending, eMarketer estimates. And after search traffic on mobile surpassed desktop last year, ads followed suit, eMarketer estimates.

About 59.5 percent of the company’s net global ad revenues will come from mobile internet ads this year, up from about 45.8 percent in 2015, according to eMarketer.

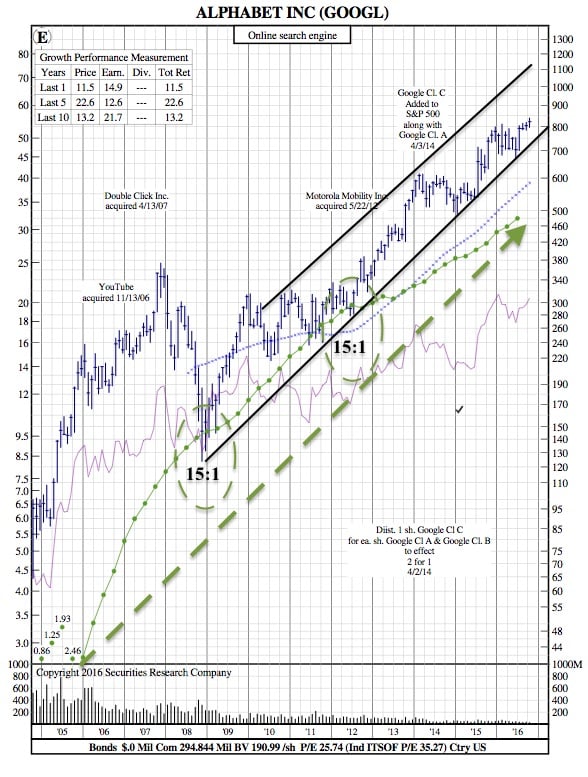

GOOGL 12-Year Chart:

Alphabet has been on quite the tear over the past 10 years, growing at over 21%. This strong growth has only let up slightly, as Alphabet’s stock price and earnings have increased 11.5% and 15%, respectively, over the year. Alphabet remains one of the top momentum stocks available to investors, especially after today’s news.