Two Leveraged Exchange-Traded S&P 500 Funds and their 12-Year Charts

Investopedia — There are over 1,800 exchange-traded funds (ETFs) available to investors, and so much choice can lead to paralysis when it comes to choosing the right funds for your portfolio.

Leveraged funds use debt to achieve returns typically two or three times the index they track. For example, a fund with a 2:1 ratio would match each dollar of investor capital with $1 of invested debt (via futures contracts, derivatives), which in theory would double the return, less any management fees and transaction costs. If the index achieves a 1% gain, a 2:1 leveraged fund would return 2%. Of course, the opposite is also true: a 1% loss becomes 2% in a leveraged ETF.

These funds are not generally considered long-term investment options. In fact, most investors limit their exposure to a leveraged fund for a single day or matter of days in order to capitalize on a positive run of the underlying index. It’s important to note that these funds are rebalanced daily and as a result, performance numbers may not closely track long-term performance of the S&P 500.

If you are interested in exposure to a leveraged ETF, here are 4 leveraged S&P indexed funds that are outperforming their peers.

All year-to-date returns are based on the period of January 2016 through November 30, 2016. Funds were selected on a combination of performance and assets under management.

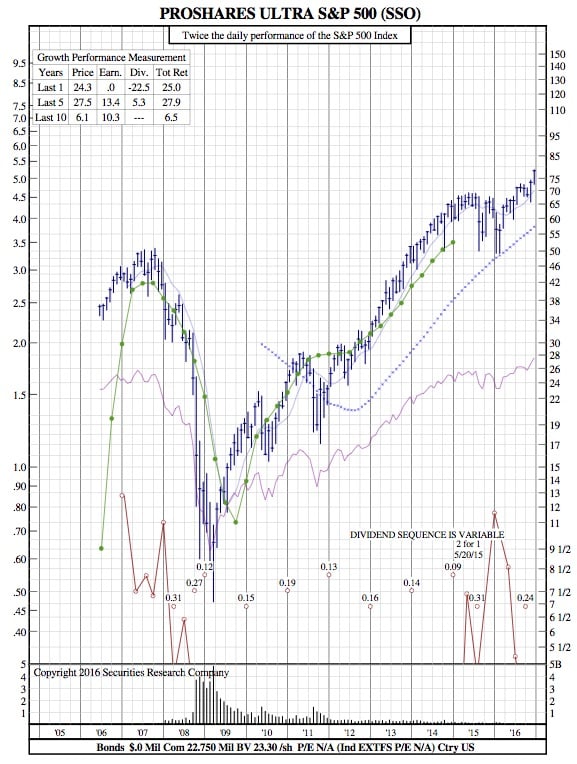

ProShares Ultra S&P 500 ETF (SSO)

- Issuer: ProShares

- Assets Under Management: $1.48 billion

- YTD Performance: 16.81%

- Expense Ratio: 0.89%

This leveraged fund seeks to double the return of the S&P 500 for a single day (from one NAV calculation to the next) using stocks and derivatives. Since its inception in 2006, the fund has delivered 8.94%. Its one-year, three-year, and five-year returns are 12.62%, 15.05%, and 26.88%, respectively.

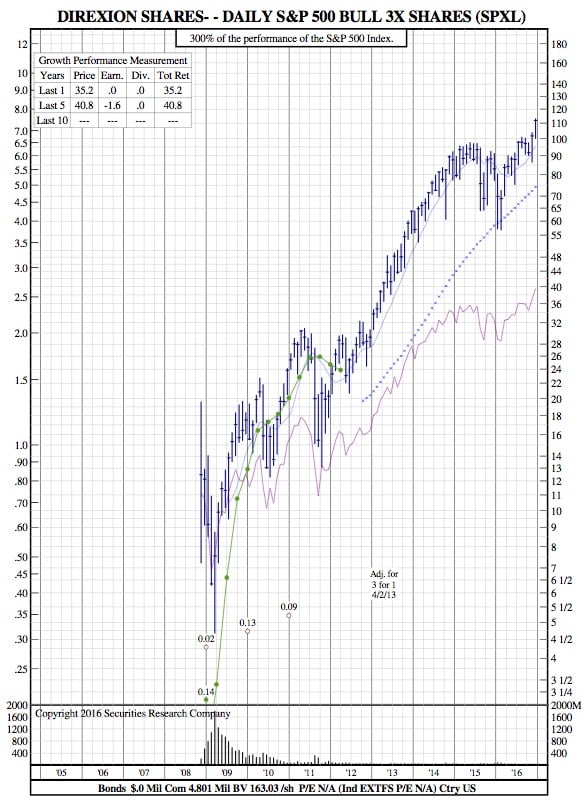

Direxion Daily S&P 500 Bull 3x Shares ETF (SPXL)

- Issuer: Direxion Funds

- Assets Under Management: $503.4 million

- YTD Performance: 22.54%

- Expense Ratio: 0.96%

Direxion offers two S&P 500 leveraged S&P ETFs that seek to produce three times the return of the index on a daily basis. Direxion also has a companion fund, the Bear 3x shares, which aims for returns of 300% of the inverse of the S&P. Since its inception in 2008, the fund has achieved returns of 24.83%, with one-year, three-year, and five-year returns of 15.55%, 19.66%, and 38.42%.