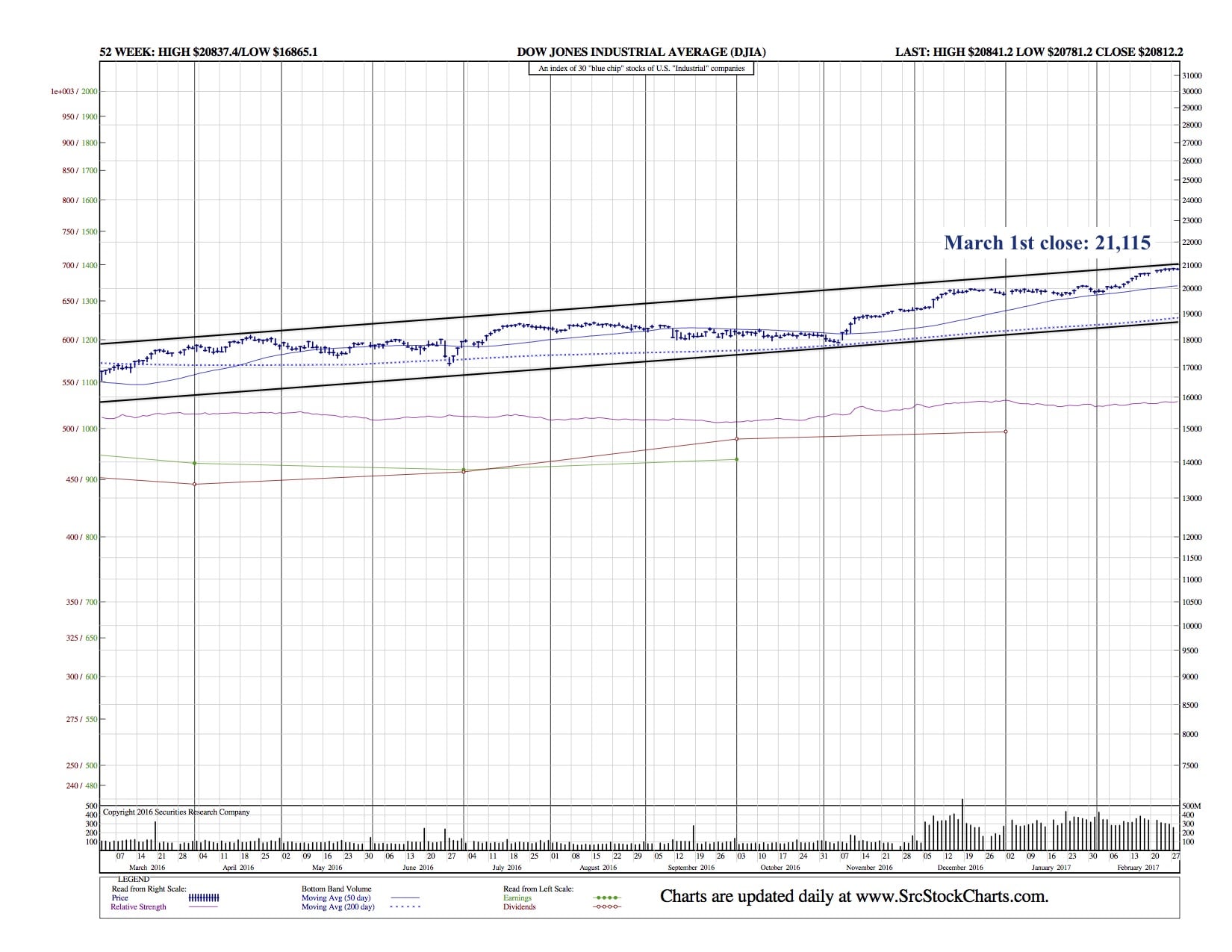

The Dow blows past latest 21,000 Milestone (DJIA Daily Chart Included)

WSJ — The Dow Jones Industrial Average surged more than 300 points to cross 21000 for the first time Wednesday, as investors embraced optimism from President Donald Trump and Federal Reserve officials.

Stocks have soared since November, with the blue-chip index surpassing 19000, 20000—and now 21000—since Election Day. Enthusiasm for Mr. Trump’s plans to cut taxes, loosen regulations and ramp up fiscal spending have bolstered shares alongside signs of improvement in the U.S. economy.

DJIA Daily Chart:

The Dow rose 303 points, or 1.5%, to 21116 on Wednesday. The last time it posted a gain of more than 300 points was the day before the election.

The latest push ties its fastest thousand-point jump in history: It took 24 sessions from the first close above 10000 for the index to climb to 11000 in 1999.

Investors scooped up shares broadly on Wednesday, sending nearly all 30 Dow components higher. Apple rose 2% and has been one of the biggest contributors to the Dow’s point gain since the index first closed above 20000 on Jan. 25.

The S&P 500 rose 1.4% Wednesday, and the Nasdaq Composite added 1.4%.

The rally came after Mr. Trump struck an optimistic tone in a speech to Congress on Tuesday evening, although he offered few new details for his agenda. Investors were also focused on the likelihood of the Fed raising interest rates in March, following comments from a number of officials suggesting another quarter-point interest rate increase could come at the central bank’s next meeting.

“The market woke up this morning believing in Trump’s ability to enact a pro-business agenda,” said Tom Wright, director of equities at JMP Securities. “The trend has been up, because of underlying optimism, but it’s been tempered by concern they may not be able to get that agenda through Congress.”

Investors ditched U.S. government bonds and bought the dollar. The WSJ Dollar Index, which tracks the U.S. currency against 16 others, was recently up 0.3%. The yield on the benchmark 10-year Treasury note rose to 2.462%, according to Tradeweb, from 2.358% Tuesday.

As bond yields rose, bank stocks surged. Financial shares in the S&P 500 rose 2.8%, leading gains. Bank of America rose 3.6% and J.P. Morgan Chase added 3.3%. Higher interest rates tend to boost the profitability of banks’ lending activities.

New York Fed President William Dudley, a close ally of Fed Chairwoman Janet Yellen, on Tuesday said the case for raising rates “has become a lot more compelling” in light of the economy’s current and expected performance. San Francisco Fed President John Williams also said in a speech Tuesday that a rate increase at the central bank’s meeting in March was “very much on the table for serious consideration.” Ms. Yellen is scheduled to speak Friday.

The personal-consumption-expenditures price index, the Fed’s preferred inflation gauge, rose in January, the Commerce Department said Wednesday. It was the latest sign of firming price pressures that could bolster the case for the central bank to raise rates as soon as this month.

Fed-fund futures, used by investors to place bets on central-bank policy, showed a roughly 66% chance of a rate rise in March, up from 35% Tuesday, according to CME Group.

Stocks’ steady gains, without a substantial pullback, have some investors and analysts concerned that shares have gone too far too fast. Investors have bought into postelection dips and the S&P 500 hasn’t declined 1% or more in a day since October.

“I’m usually pretty bullish, but I’m worried there’s too many people who have joined the party,” said Tom Digenan, head of U.S. equities at UBS Global Asset Management.

In addition, U.S. stocks are more expensive than their historical averages by some measures. Companies in the S&P 500 traded at an average of roughly 22 times their past 12 months of earnings this week, above their 10-year average of around 16, according to FactSet.

Major indexes could still push higher.

A measure of investor sentiment from Bank of America Merrill Lynch reached a 16-month high in February, but remained below levels hit as the market bottomed in March 2009. When the indicator has been as low or lower, total returns over the next 12 months have been positive 94% of the time, according to the firm’s analysis.