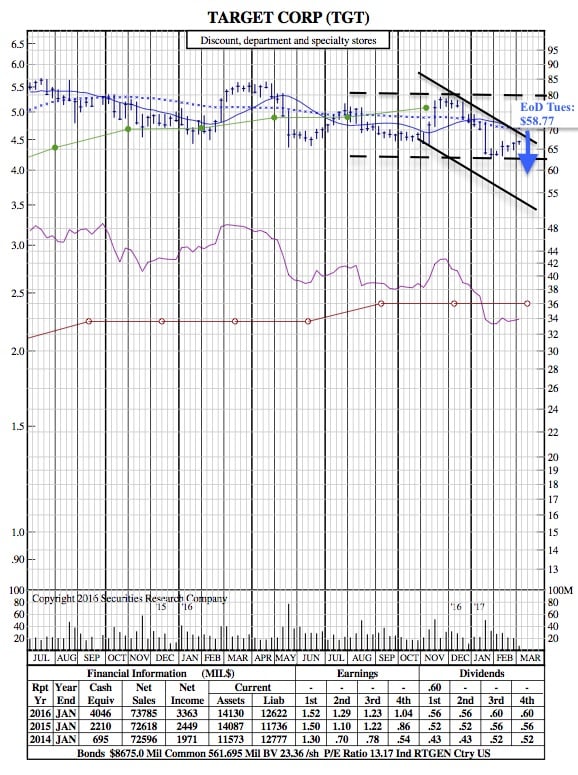

Target 21-Month Chart after Record Price Drop

MarketWatch — Target Corp. shares were suffering their biggest-ever price drop in active trade Tuesday, as the discount retail giant struggles to cope with the “rapidly changing” behavior of consumers.

Target reported before the open bell fiscal fourth-quarter profit that missed expectations and provided first quarter and full-year guidance that was well below analyst projections. The company said that investments it would make as it transitions to a new financial model will weigh on results in the short term.

That drove the stock TGT, +0.14% down $8.14, or 12.2%, to the lowest price seen since Aug. 20, 2014. Recent volume of over 37 million shares was nearly six-times the full-day average.

The selloff was the biggest one-day price decline since Target’s stock started trading in January 1972, according to FactSet. The second-biggest price drop was $5.61 on May 18, 2016, also after reporting quarterly results.

TGT 21-Month Chart:

The one-day percentage decline was the fifth-biggest ever, and the largest since it plummeted 12.50% on Dec. 1, 2008, according to FactSet. The biggest decline was 33% on Oct. 19, 1987, or Black Monday.

The one-day percentage decline was the fifth-biggest ever, and the largest since it plummeted 12.50% on Dec. 1, 2008, according to FactSet. The biggest decline was 33% on Oct. 19, 1987, or Black Monday.

“Our fourth-quarter results reflect the impact of rapidly changing consumer behavior, which drove very strong digital growth but unexpected softness in our stores,” said Chief Executive Brian Cornell. “While the transition to this new model will present headwinds to our sales and profit performance in the short term, we are confident that these changes will best position Target for continued success over the long term.”

Target’s disappointing results were in contrast to better-than-expected earnings reported by rival Wal-Mart Stores Inc. WMT, -1.13% and Home Depot Inc.HD, +0.00% last week.

In a meeting with Wall Street analysts, Target provided some detail on the investments and changes it was making to deal with the “new era” in retail.

The investments include $1 billion in operating margins in 2017 to ensure prices are competitive, revamp more than 100 stores and other efforts. The retailer will invest more than $7 billion over the next three years with plans to update more than 600 stores and open more than 100 small-format stores by 2019 and introduce more than 12 new brands over the next two years.

“While the transition to this new model will present headwinds to our sales and profit performance in the short term, we are confident that these changes will best position Target for continued success over the long term,” Cornell said.

Target shares have now tumbled 24% over the past three months, while the SPDR S&P Retail exchange-traded fund XRT, -2.50% has lost 6.8% and the S&P 500 indexSPX, -0.26% has gained 7.4%.