Could Microsoft be the first of the Tech Giants to hit the Coveted $1 Trillion Market Cap? A look at the 35-Year Chart…

TechWorm — We are talking about trillions here. Microsoft Corp. could be the first company in the world to have a $1 trillion valuation, following its $26.2 billion acquisition of LinkedIn Corp, according to Equities.com analyst, Michael Markowski. Currently, the Redmond giant has a market capitalization of around $492 billion.

His recent analysis states that Apple has the highest market value (of $621.32 billion as of December 27), followed by Alphabet ($557 billion), and Microsoft coming in at third position at $491.71 billion.

“Since Microsoft has the highest free cash flow yield of the 10 companies in my digital universe, it’s the most undervalued. Microsoft clearly has the potential to outperform the market. Most importantly, the downside for its share price is limited since the current dividend yield is 2.5 percent,” Markowski surmises for Equities.com.

Microsoft might also profit from a couple of rulings from the U.S. Securities and Exchange Commission that opens up online crowdfunding by allowing companies to advertise to the public and investors who are not accredited to participate in fundraising rounds.

“The public has an insatiable appetite for making small bets and purchasing lottery tickets, etc., that provide the chance to make a big profit,” Markowski said. “The millennials will be a good example. Many will want to routinely invest $100 or even less into high-risk ventures that could produce returns of 10X to 100X.”

Capping off his analysis, Markowski predicts that the social media industry will help drive online equity crowdfunding in the future. “The acquisition positions Microsoft to be a leader in the emerging Social Investing Community (SIC) industry, which is the key to online equity crowdfunding becoming ubiquitous. The SIC industry is in its infancy. However, my prediction is that by 2025, it will rank in size and scope right along with the digital search and social media industries,” Markowski said.

Whether or not Markowski’s predictions turn into reality remain to be seen. On the other hand, RBC Capital Markets analyst Mark Mahaney recently predicted that Amazon, the retail and cloud computing giant, would be the first company to hit the $1 trillion mark.

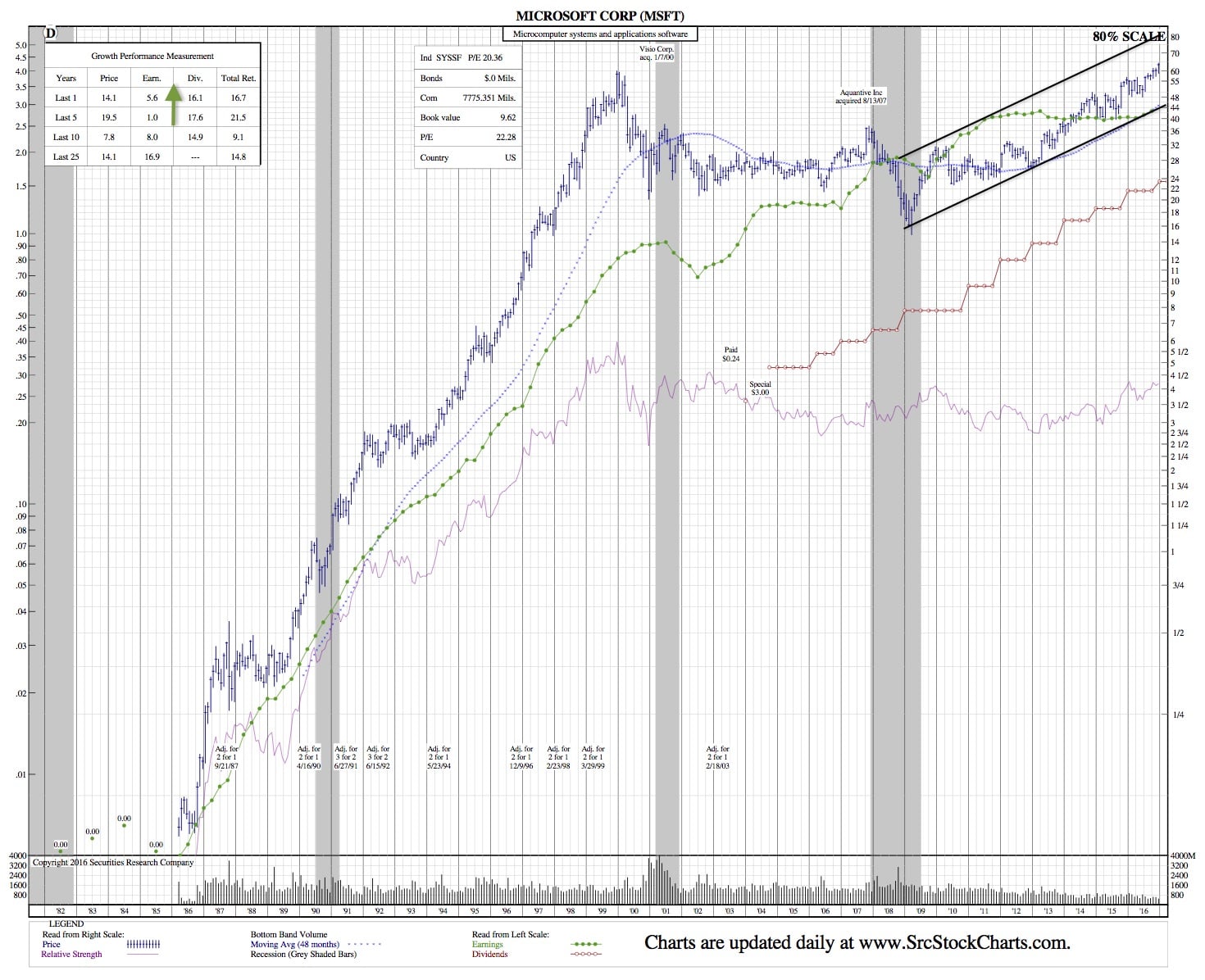

Microsoft 35-Year Chart: