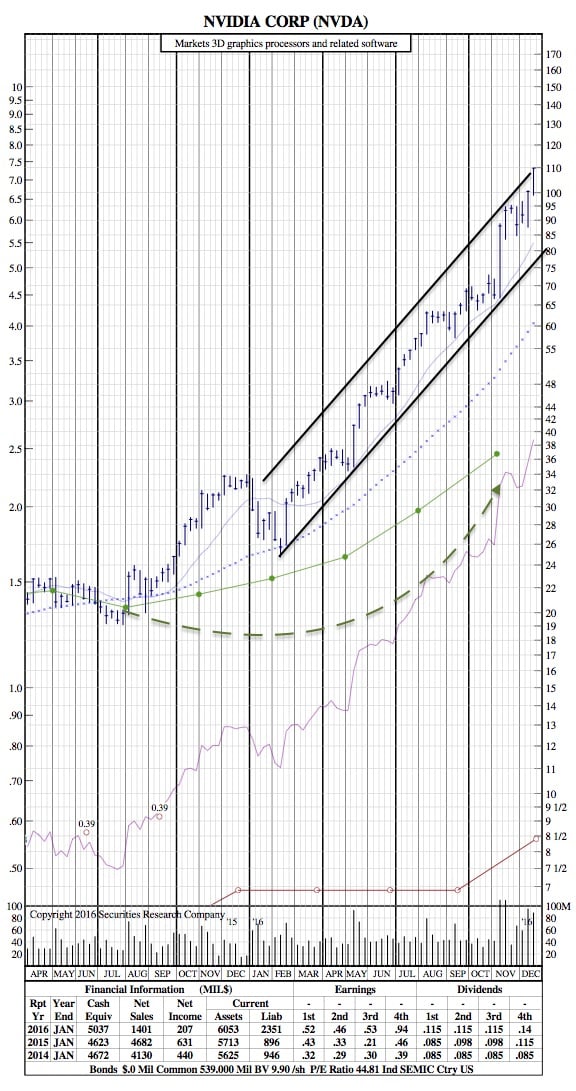

Can NVIDIA Keep Up Its Momentum in 2017? (21-Month Chart Included)

VR gaming market opportunity may drive NVDA stock much higher.

Insider Monkey-– After a couple of recent analyst upgrades, NVDA stock has also been added by Goldman Sach to its ‘Conviction Buy List’.

– After a monstrous 219% gain in 2016, can NVDA stock gain anything close to this figure in 2017?

The shares of NVIDIA Corporation (NASDAQ:NVDA) (1) have gone through the roof in 2016, yesterday again NVDA stock was up by almost 3.5%. It closed yesterday’s trading session at $105.17, up by a humongous 219% from its price of $32.96 at the beginning of the year. The flurry of analyst upgrades and price target hikes indicate the stock still has huge upside potential. Goldman Sachs’s Toshiya Hari was the latest to reiterate a buy rating on NVDA stock after Evercore ISI and Loop Capital recently upgraded their NVDA price targets. With so much bullish euphoria around NVDA stock, how close can it get to its 2016 performance in 2017 is the big question. Which new catalysts will keep propelling NVDA stock, and how will these recent analyst upgrades pan out? Let’s take a closer look.

VR Gaming Market – The Next Big Growth Driver

Goldman Sachs mentioned gaming and VR as some of the big trends for Nvidia’s rating upgrade. With Nvidia gaining more GPU market share steadily, it could be in for more impressive gains due to a rapidly growing virtual reality video gaming market. The virtual reality video gaming hardware market is expected to generate approximately $5 billion in revenue in 2016, which is significantly up from $660 million in 2015. Already Nvidia is a market leader in the gaming segment, but with this new massive opportunity ahead it could push its top line further higher by capturing this market.

The VR gaming hardware market will grow to $8.9 billion in 2017 and $12.3 billion in 2018, and NVDA is well placed in this segment with its new offerings here. Nvidia’s offerings have been a huge hit among the gaming community: with its Quadro M5500 GPU, it will offer the gamers a superior virtual gaming experience by allowing them to launch virtual reality workstations though its PC partners. This GPU is based on Nvidia’s Maxwell 2 architecture and is powered by 8 GB of GDDR5 RAM. Nvidia is of the opinion that the M5500 GPU is the fastest GPU in its segment.

AR/VR is a fast growing multi-billion dollar market, estimated to generate $120B revenue by 2020, and VR gaming is a major part of it. NVIDIA Corporation (NASDAQ:NVDA)’s revenue from VR GPUs could be as much as $8 billion in 2018, much higher than Nvidia’s overall gaming revenue in the past four quarters of $3.5 billion. If Nvidia takes its gaming dominance into the VR gaming space it can substantially grow its top line from just this market alone. The VR market opportunity is really massive and the potential of this market gives you more reasons to be bullish about NVDA stock. Given Nvidia’s gaming segment track record, one need not be surprised if this becomes the new growth catalyst for Nvidia, driving NVDA stock much higher than expected in 2017.

NVIDIA 21-Month Chart: