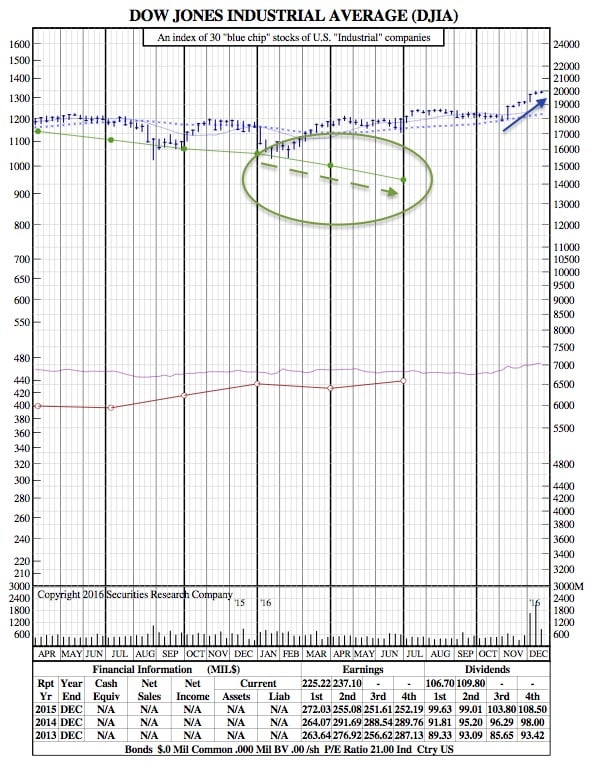

Dow 20,000 isn’t Necessarily Inevitable before 2017 (21-Month Chart Included)

MarketWatch — With all the breathless anticipation over the Dow Jones Industrial Average’s random walk to 20,000—a milestone only significant for its impact on Wall Street’s psyche—investors would think hitting the level this year was assured.

However, there are growing signs that although the Dow DJIA, +0.07% is oh-so-close to touching rarefied air, it might face sufficient resistance over the next several days to thwart its ascent. The Dow rose to within 14 points of reaching 20,000 Wednesday morning, but then faded to end the day about 60 points away, and slightly lower, along with the S&P 500 index SPX, +0.13% and the Nasdaq Composite Index COMP, +0.28% On Friday, the Dow ended mostly flat after posting its first back-to-back losses in six weeks, placing the benchmark about 70 points from the promised land.

The jinx

The market has given so much attention to the Dow hitting the never-before-reached mark, that it may be starting to serve as a barrier to piercing through the level.

Sideways action

The Dow has been trading in a narrow range and that could mean a lot of bouncing around just below 20,000 until year-end. MarketWatch’s Tomi Kilgore points out that the Dow on Wednesday traded at its tightest intraday range, just about 44 points, in more than two years.

Moreover, Wall Street’s fear gauge, the CBOE Volatility Index VIX, +0.09% hit a 16-month low, suggesting that markets aren’t making big bets on sizable swings in prices in the near-term. (That isn’t to say that it will take much to tip the blue-chip gauge to a milestone.)

Tax-loss harvesting

Although excitement over the potential that President-elect Donald Trump will enact business-friendly rules and take an ax to corporate taxes has kept the typical seasonal selling patterns in abeyance, as investors bet on lower tax rates in the coming year or two, investors have other reasons to sell.

The market forces that want to push the Dow higher are competing with market participants aiming to sell. So-called tax-loss harvesting is when investors unload holdings whose values have declined below where they were purchase. The losses realized can be used at tax time to partially offset gains from the sale of other securities.

Jimmy Lee, CEO of Wealth Consulting Group in Las Vegas, which manages $900 million, said he has been doing a lot of that for his clients. He predicts that the Dow won’t close at 20,000 in 2016 partly for that reason. “I don’t think we’ll close [at Dow 20,000] until the jobs report on Jan. 6,” he told MarketWatch.

Momentum fading

Sven Henrich, financial blogger at NorthmanTrader, makes the case that the aforementioned low volatility in the market and a pervasiveness of irrational exuberance is the right recipe for the market’s recent uptrend to fade. This is a debatable point among Wall Street watchers. Remember, the Dow closed at another record on Tuesday, which was the 17th record since the election, and an indication that the trend may still be positive.

Can Wall Street close this gender gap?

Women have only half the retirement savings of men, even though they control $5 trillion in investible assets. Can Wall Street get women to invest more?

Relatively healthy U.S. economic reports haven’t done much to nudge the market higher either—at least not yet. A slow December holiday period, where volume and appetite for risk starts to fade isn’t helping. And although that could also mean markets are prone to volatility, market participants have indicated that there aren’t a lot of big-block trades that would help nudge the benchmark up.

Technical resistance

Market technicians believe that the stock market’s recent moves are pointing to a so-called consolidation phase, in which the market pulls back slightly to refresh, before making another advance. Katie Stockton, chief technical strategist at BTIG in a Thursday note said as much, referring to the broad-market S&P 500 index.

“The S&P futures have seen a significant loss of short-term momentum, enough to generate the first ‘sell’ signal in the daily [moving average convergence divergence] indicator since it turned positive on November 8th,” she wrote. And if the S&P 500 is going to fade, the Dow is likely to move in step with its broader market brethren.

Stockton added that financials, like Goldman Sachs Group GS, +0.35% which have been among the strongest performers in both the S&P 500 and the Dow’s march to records, to start to lead the market in a new phase of near-term retrenchment. The SPDR S&P Bank ETF KBE, +0.07% one popular way to bet on the financial sector, is on pace to return 30% in 2016, while another financial ETF, the Financial Select Sector SPDR ETF XLF, +0.17% has gained 22% so far this year.

At the end of the day, hitting Dow 20,000, as MarketWatch has written before, is more of a confirmation of an upward trend than a key metric, as many who follow markets have pointed out.: