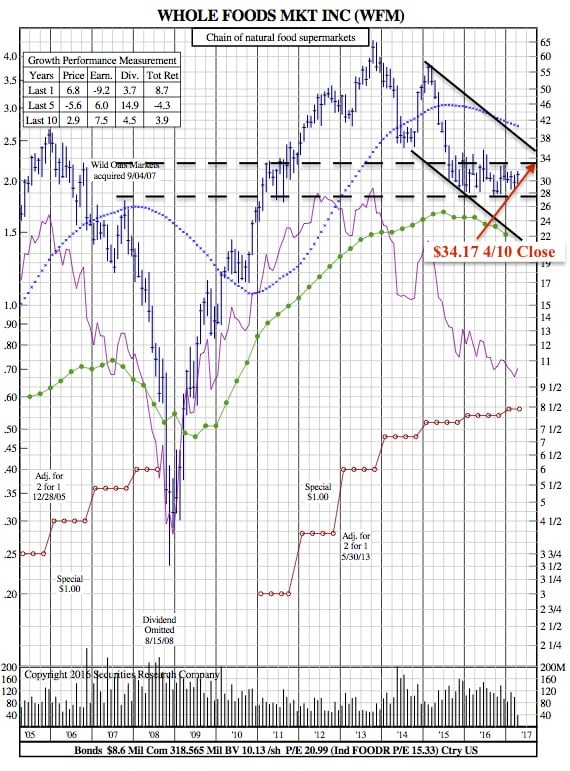

Whole Foods Pops Nearly 10% as Activist Investor, Jana Partners Increases Stake (12-Year Chart)

WSJ — An activist investor has amassed a large stake in Whole Foods Market Inc. WFM 9.98% and wants it to accelerate its turnaround and explore a possible sale, increasing pressure on the upscale organic grocer to find its footing now that its rapid growth has stalled.

Jana Partners LLC, which has built up an 8.8% stake in Whole Foods along with several allies, wants the chain to improve its technology and operations to better compete with larger rivals, shake up its board and find out how much a potential bidder might be willing to pay, according to a Monday regulatory filing.

Whole Foods couldn’t immediately comment.

Jana’s campaign is the latest quandary for Whole Foods, which has struggled to make the transition from the highflying upstart with a loyal following into a large, national chain with the kind of back-office systems tracking customers and inventory that rivals use to keep costs down and sales up.

Whole Foods’ stock had risen 4% over the past 12 months before The Wall Street Journal reported that Jana had taken a stake in the company, compared with a 15% gain in the S&P 500. The stock, which has lost more than half of its value since peaking in 2013, jumped more than 10% Monday afternoon.

Sales, meanwhile, have fallen over the past 18 months. Same-store sales—a key retailer metric—fell 2.5% during its fiscal year that ended in September 2016.

Jana has lined up a potential slate of board nominees, according to the filing, four months before the deadline to launch a board fight. That is likely a signal that Jana, which has quietly reached settlements with several companies this year to install new directors, will be aggressive in demanding change at Whole Foods.

The fund’s board candidates include longtime industry analyst Meredith Adler, Thomas “Tad” Dickson, the former CEO of Harris Teeter Supermarkets, and Glenn Murphy, who led the turnaround of Gap Inc. as the retailer’s chief executive.

The fund is also working with well-known chef, food writer and entrepreneur Mark Bittman and Diane Dietz, the former chief marketing officer of Safeway Inc., which Jana helped shake up in 2013.

Mr. Bittman and Ms. Dietz, along with the three board candidates, all purchased shares in Whole Foods as part of Jana’s campaign.

Jana hasn’t yet met with Whole Foods’ current board or executives, according to people familiar with the matter, departing from its usual approach of quietly working with management and boards behind the scenes. The hedge fund, founded by Barry Rosenstein in 2001, has played a role in changing the boards of Bristol-Myers Squibb Co., Tiffany & Co. and Blackhawk Network Holdings Inc., all without the kind of public fight associated with activists.

Jana’s campaign will amplify the quieter grumblings of other Whole Foods shareholders. Some investors have said the company should consider selling itself and have floated rival Kroger Co. and Amazon.com Inc., which is building out a physical grocery-store chain, as possible buyers.

After Monday’s bump, Whole Foods’ market value stands at around $11 billion.

Mutual-fund giant Neuberger Berman, which owns about 2.4% of Whole Foods, has been privately pushing for faster change at the company, the Journal has reported. The firm has complained that the chain hasn’t fully capitalized on its popularity among millennials or prepared foods sales, areas where it bests its rivals.

At Whole Foods’ annual meeting in February, the board was re-elected but faced a high protest vote. Two directors garnered around 85% support, while an advisory vote on executive compensation got 84%, levels that signal investor angst.

Some investors say that while the company is taking the right steps, it is moving too slowly to catch up to rivals that are years ahead in retail technology and customer management. They have indicated that management had to perform this year or risk a louder uprising this fall.

“We think [Whole Foods] needs to move from a growth phase to an efficiency phase,” UBS analysts wrote in tagging the company with a sell rating last month. “The entrepreneurial culture that served it well in its growth mode now needs to be more process-oriented. That can be a rough transition.”

The broader grocery industry is struggling with increased competition and a slump in food prices that has eaten into profits. But Whole Foods has struggled in particular as it has lost ground in the natural and organic market that it once dominated.

As pressure has mounted, Whole Foods has cut costs and abandoned an ambitious plan to nearly triple its number of stores. It has tried various marketing gambits to retain customers. The company began testing a loyalty program in 2014. Whole Foods intends to expand it nationally from a pilot in the Dallas area.

Chief Executive John Mackey has said he expects these efforts to reverse the company’s fortunes. But Whole Foods revised down its sales and profit forecasts for the year in February.

WFM 12-Year Chart: