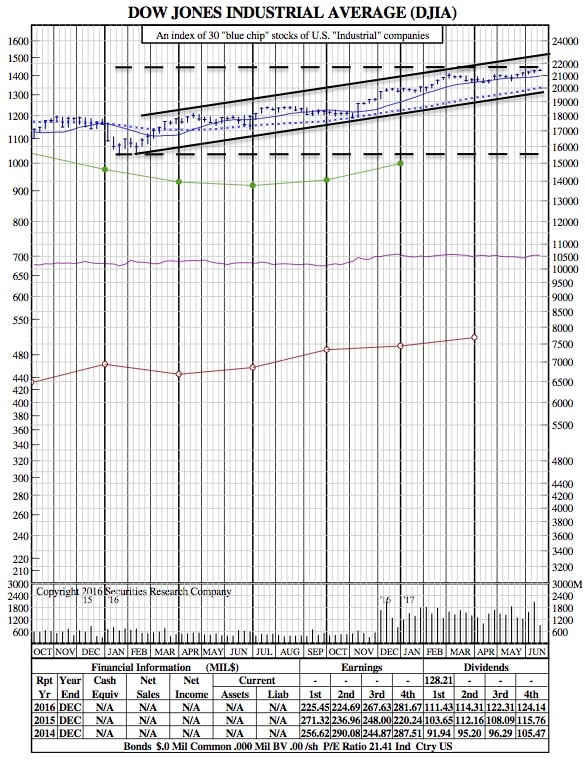

July Starts off with a Bang as the Dow Hits Record High (21-Month Chart)

Reuters — The S&P 500 and Dow Industrials moved higher on Monday, with the Dow hitting an intraday record as energy and bank stocks gained, but continued weakness in the technology sector pulled the Nasdaq lower.

The S&P energy index rose 2.0 percent, its best performance in nearly a month, led by gains in Exxon Mobil and Chevron.

Both Brent and U.S. crude climbed more than 1 percent to resume its longest stretch of daily rallies in more than five years after data pointed to moderating U.S. output, pushing energy names higher.

“Oil is rallying today so that is causing some excitement in the energy space, but that is what you would expect because oil has been so beaten up,” said Ken Polcari, Director of the NYSE floor division at O’Neil Securities in New York.

Financials, up 1.3 percent, also supported gains. With the sector notching its sixth advance in the seven sessions.

The Nasdaq was lower as the technology sector saw its recent struggles continue, down 0.9 on the session after a drop of nearly 3 percent last week.

Trading volume was light on Monday, due to the abbreviated trading session ahead of the Independence Day holiday on Tuesday.

The Dow Jones Industrial Average rose 129.64 points, or 0.61 percent, to 21,479.27, the S&P 500 gained 5.6 points, or 0.23 percent, to 2,429.01 and the Nasdaq Composite dropped 30.36 points, or 0.49 percent, to 6,110.06.

Also helping sentiment was data that showed U.S. factory activity jumped in June to its highest level in almost three years suggesting economic growth in the second quarter gained some steam, while construction spending held steady in May.

The Institute for Supply Management said its index of national factory activity rose to a reading of 57.8 last month from 54.9 in May.

In a bullish signal for the market, the Dow Transportation Average, which includes airlines, railroads and package delivery companies and is often viewed as a barometer of economic activity, closed at a record.

“If (people) are comfortable with the economy, the transports certainly is a leading sector. If the economy is going to get better, transports, rails, truckers, airlines and all that stuff will do better in anticipation of that,” Polcari said.

Automakers advanced, with Ford up 3.3 percent and General Motors up 1.8 percent as vehicle sales figures for June showed retail sales to consumers were relatively stable at the U.S. automakers.

Advancing issues outnumbered declining ones on the NYSE by a 2.55-to-1 ratio; on Nasdaq, a 1.51-to-1 ratio favored advancers.

About 3.77 billion shares changed hands on U.S. exchanges, compared with the 7.18 billion daily average over the last 20 sessions.

DJIA 21-Month Chart: