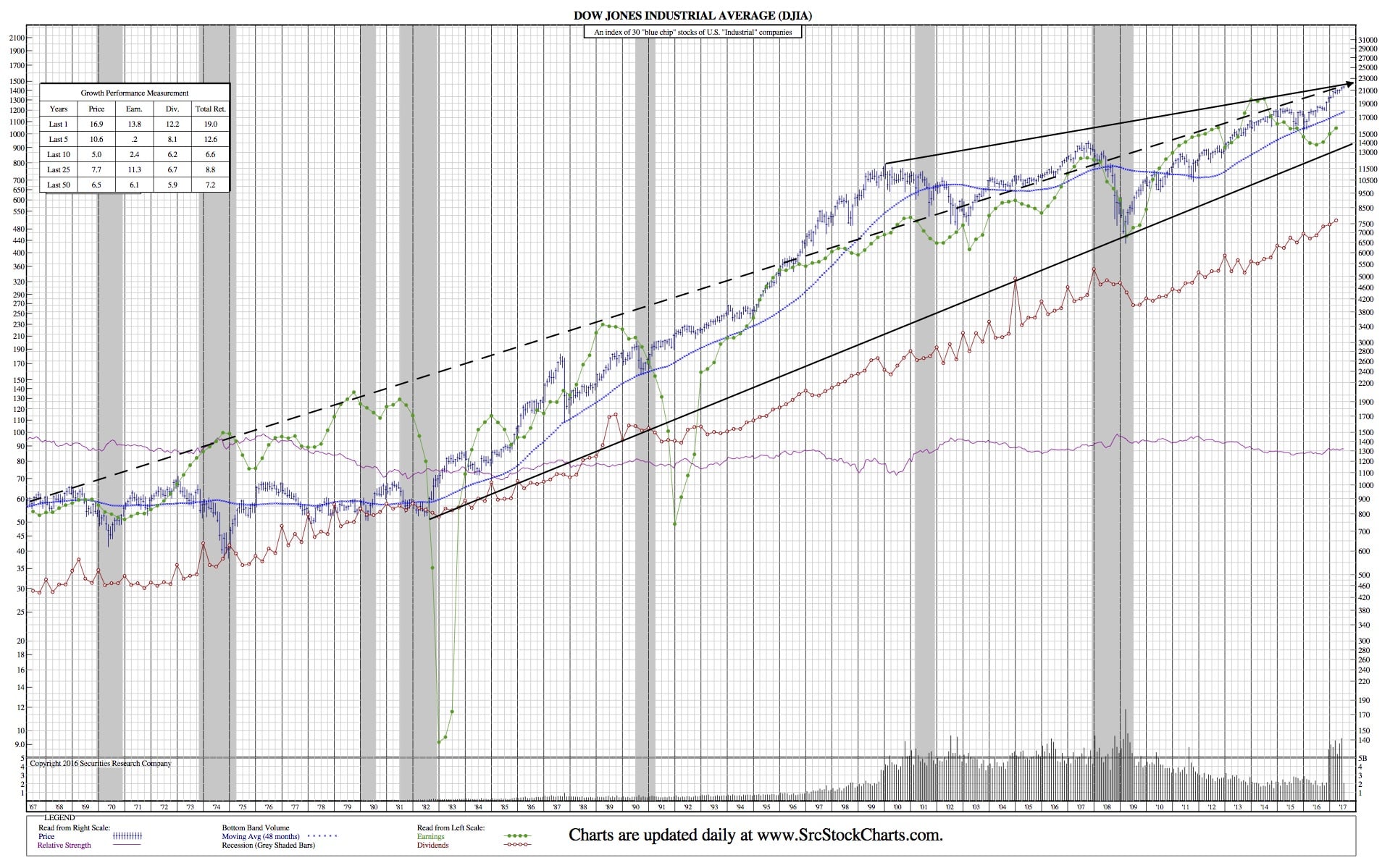

July 21, 2017: A Week In-Review (DJIA 50-Year Chart)

NEW YORK (Reuters) – U.S. stocks ticked lower on Friday as weak earnings from industrial giant General Electric weighed, while tech shares retreated from record highs and energy tracked the price of oil lower.

NEW YORK (Reuters) – U.S. stocks ticked lower on Friday as weak earnings from industrial giant General Electric weighed, while tech shares retreated from record highs and energy tracked the price of oil lower.

GE (GE.N) shares fell 2.9 percent to $25.91 and hit their lowest level since October 2015. The company reported a nearly 60 percent slump in profit and said its full year profit and cash flow will be at the low end of its forecasts.

Peers in the industrial sector (.SLPRCI), such as Caterpillar (CAT.N) and 3M (MMM.N), also fell.

But Honeywell (HON.N) touched a record high and ended up 1.0 percent at $136.35 after it raised the low-end of its profit forecast.

“We’ve had a good run for the last few weeks and investors are primarily digesting earnings today,” said Erick Ormsby, chief executive of Alcosta Capital Management.

“GE’s results were okay but they guided lower and that’s weighing on the market, too.”

The S&P 500 energy sector (.SPNY) fell more than 1 percent as oil prices lost nearly 3 percent, after a consultancy report forecast a rise in OPEC production for July despite the cartel’s pledge to curb output.

The S&P 500 technology sector (.SPLRCT) slipped after posting two consecutive record closing highs. The Nasdaq Composite was on track to cap a 10-day streak of gains, its best since February 2015, after closing at a record high on Thursday.

Tech continues to be the best performing S&P sector this year despite concerns over stretched valuations.

Microsoft (MSFT.O) shares fell 0.6 to $73.79 despite a strong earnings beat after the bell Thursday, propped in large part by its fast-growing cloud computing business.

Analysts expect S&P 500 earnings to have climbed 9.6 percent year-over-year, above the 8-percent rise projected at the start of the month, according to Thomson Reuters I/B/E/S.

The Dow Jones Industrial Average (.DJI) fell 31.71 points, or 0.15 percent, to 21,580.07, the S&P 500 (.SPX) lost 0.91 points, or 0.04 percent, to 2,472.54 and the Nasdaq Composite (.IXIC) dropped 2.25 points, or 0.04 percent, to 6,387.75.

The S&P and the Nasdaq rose for a third straight week.

Capital One (COF.N) reported a profit beat, helped by growth in card loans and net interest income. Its shares rose 8.6 to $87.94, its biggest daily percentage gain in eight years.

Visa (V.N) rose 1.5 percent to $99.60. The world’s largest payments network operator raised its annual earnings forecast.

“What’s important is the directionality of earnings, and earnings are going up. We’ve transitioned from an interest rate-driven secular bull market to an earnings-driven secular bull market,” said Jeffrey Saut, chief investment strategist at Raymond James Financial in St. Petersburg, Florida.

Declining issues outnumbered advancing ones on the NYSE by a 1.09-to-1 ratio; on Nasdaq, a 1.46-to-1 ratio favored decliners.

About 5.73 billion shares changed hands on U.S. exchanges, below the 6.31 billion daily average over the last 20 sessions.