Does Procter & Gamble’s 12-Year Chart Indicate Room to Run?

The Street — Procter & Gamble (PG) is on the right track with its restructuring program. Two weeks ago, the company presented at the Consumer Analyst Group of New York. It was a chance to update the investor community on its progress this year. Procter & Gamble is in the middle of a five-year restructuring plan, but has been struggling with market share losses and the effects of a strong dollar.

At the conference, management highlighted the fact that, for the first half of fiscal 2017, organic sales and volume growth are up 2.5% vs. last year, when sales and volume were flat and down 2.5%, respectively.

In the four largest categories (fabric care, hair, baby, and grooming), first half organic sales are up in each category. For example, organic sales have climbed 3% in fabric, 2% in hair and grooming and 0.5% in baby. In the company’s two largest markets, the United States and China, organic sales were up 2% and 2.5%.

For the full year, the management is sticking to their forecast of the top line organic sales growth of 2-3%. All-in sales growth, which includes the effects of the strong dollar, should be flat.

In terms of the bottom line, growth in earnings per share ex-foreign currency is expected to be up 10%. Gross margin should be up around 120 basis points while operating margin ex-currency will be up about 80 basis points.

Procter & Gamble is marking progress on expenses. Since fiscal 2012, the company has chopped out $7.2 billion in cost of goods sold and reduced its workforce significantly. In addition, in 2016 it cut the number of advertising agencies it does business by 25%, saving $250 million.

Management believes they are on track to save an additional $10 billion from fiscal 2017 to 2021. Procter is cutting everything — manufacturing expense, transportation, and warehouses costs — and reducing its raw and pack materials cost. For example, in laundry, Procter scientists have cut the number of laundry formulations by 40%, reduced manufacturing operations by 50% and reduced the sheer number of package designs by 50%. This effort has reduced the number of stock keeping units (SKUs) in the laundry category by 24%.

All these changes have helped PG drive its selling, general and administrative expenses (SG&A) 110 basis points below its competition. And from fiscal 2013 to 2016, operating margin is up 2.1% to 21.5%.

Perhaps the biggest announcement at the CAGNY event was the news that Procter & Gamble is finally getting more competitive in shaving. The company plans to slash blade and razor prices at its Gillette division by 20% effective March 30. Procter has been losing market share to less expensive razors and direct-to-consumer competitors, like Harry’s and the Dollar Shave Club. With a package of 12 Gillette Fusion Pro Glide razors pushing $42, hairy people will finally have something to celebrate. Price cuts and higher promotions should help drive sales volume.

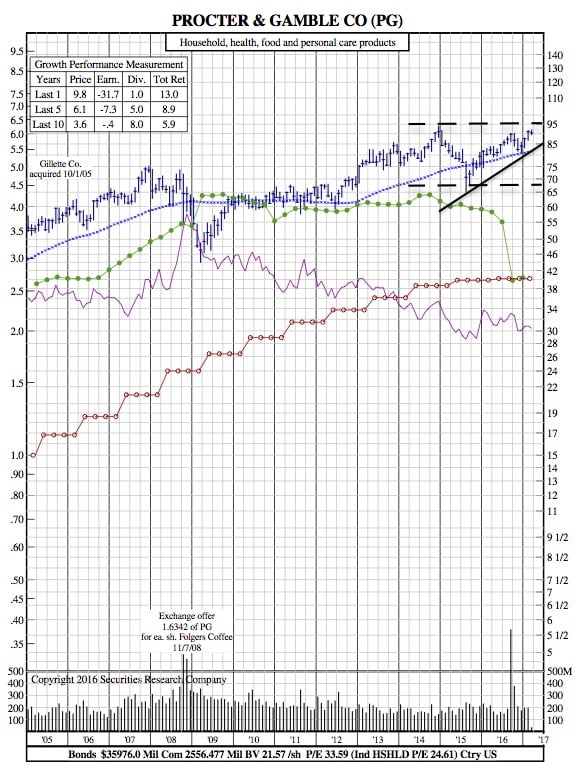

PG 12-Year Chart:

In recent weeks, analysts have trimmed Procter’s earnings per share estimates by about $0.10 to account for a softer tone to the business. The consensus is at $3.84 for 2017 and $4.13 for next year. Historically, the shares trade at 21 and 28x forward estimates, so it’s not hard to see P&G in the mid-to-high $90s, especially as we move into the second half of the year when investors begin to turn their attention to fiscal 2018 estimates.