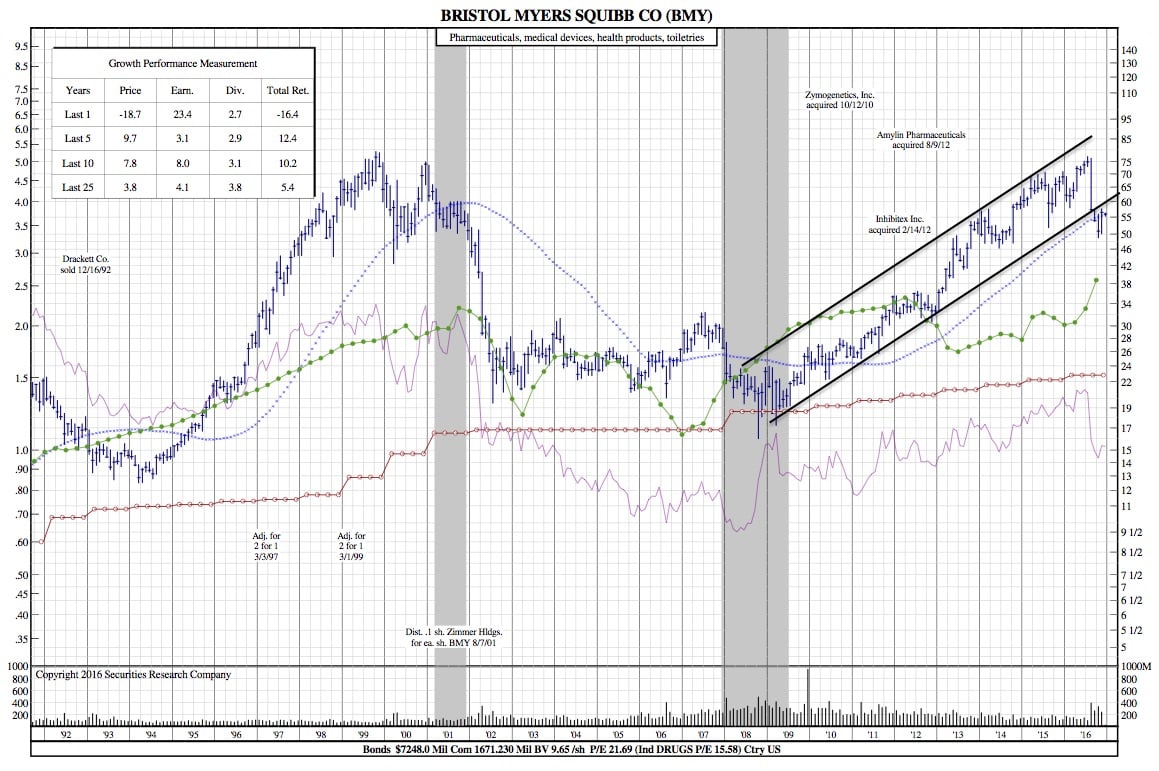

Bristol-Myers Squibb 25-Year Chart after 11% Growth in 30 days

Investopedia — Shares of Bristol-Myers Squibb Company (BMY) have risen almost 11% in the past 30 days, fueled by optimism that President-elect Donald Trump would lessen the shackles of regulation that force drug companies to keep prices low.

Bristol-Myers shares closed Friday at $55.96, up 0.29%. Shares of the New York-based drugmaker, which have risen some 10% since the end of the election, were under pressure following the late-stage clinical trial failure of its cancer drug Opdivo, which showed that patients did worse on Opdivo than those on chemotherapy.

Thanks to the arrival of the president-elect, Bristol-Myers, which at one point lost more than $20 billion in market value, is suddenly great again. But has investors’ optimism run too far? Bristol-Myers shares have traded in a range of $49.03 to $77.12 in the past 52 weeks. This means BMY stock has lost some 27% from its 52-week high and is 14% above its 52-week low. But estimates have begun to come down.

Bristol-Myers is projected to deliver earnings per share of $2.98 in fiscal 2017, down from $3.00 per share a month ago. This puts its P/E at around 19, which is two points above the S&P 500 (SPX) index. That’s not a huge premium, but the lack of upside once expected from Opdivo may weigh on earnings next year. What’s more, assuming the company earns $2.98 per share in 2017, this translates to year-over-year growth of only 4%. Conversely, if BMY stock were priced in line with the S&P 500, the shares would be valued today at around $50, or 10% below current levels.

On the positive side, its consensus price target of $62 calls for an 11% increase from current levels, suggesting that analysts aren’t too concerned about valuation or any near-term headwind that may be caused by the failure of its cancer drug Opdivo.

Bristol-Myers shares have declined 18.65% year to date, compared with a 7.24% rise in the S&P 500 index.

BMY 25-Year Chart: