Are Costco Shares Being Oversold on the Amazon, Whole Foods News? (21-Month Chart)

CNBC — Costco shares have tumbled over worries the Amazon and Whole Foods Market merger will hurt the retailer’s business. However, one Wall Street firm says it is time to buy the dip.

Raymond James raised its rating on Costco shares to outperform from market perform, predicting the retailer’s business will not be “materially impacted” and its sales growth will remain solid.

Costco shares fell 13 percent on Friday after Amazon announced its $13.7 billion deal to buy Whole Foods Market on June 16. Multiple Wall Street firms downgraded the retailer following the news.

“Admittedly, even with the recent pullback, Costco still trades at a premium valuation to the overall market and its large retail peers. Nonetheless, its business model remains intact with healthy membership growth and strong renewal rates,” analyst Budd Bugatch wrote in a note to clients Monday. “While Amazon’s agreement to buy Whole Foods, when consummated, will add a new dimension to the grocery business, it does not materially impact Costco’s unique business model, and we would be buyers on COST’s recent weakness.”

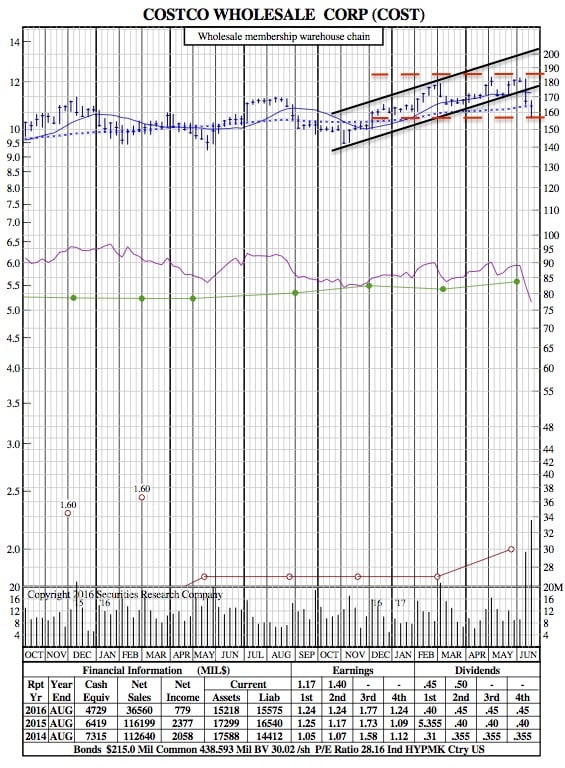

The analyst initiated his price target for the retailer at $173, representing a 10 percent upside from Friday’s close.

Bugatch noted the potential positive catalyst of Costco’s monthly June sales release on July 5th. In addition, he said the retailer’s business is “vastly different” from Whole Foods as Costco’s customers tend to buy in bulk.

“In addition, the ‘treasure hunt’ aspect of a Costco shopping trip is unique to its business model and creates a very loyal customer following,” he wrote. “Furthermore, there remains a long runway for Costco to drive top-line growth and further market share through new club openings in the United States and internationally.”

The analyst estimated Costco will increase its sales to $139 billion in 2018 from $129 billion this year.

$COST 21-Month Chart: