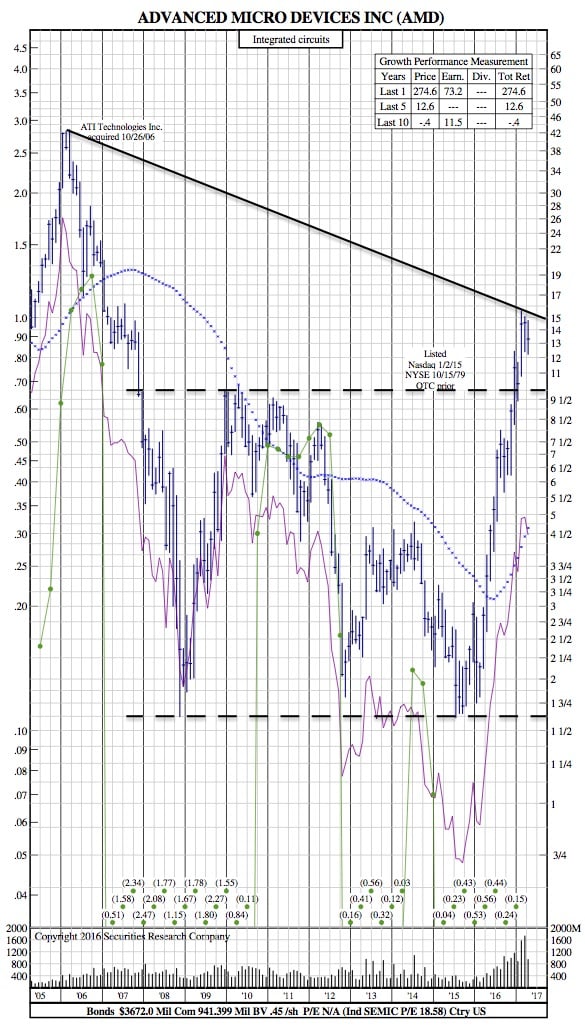

AMD Drops after Lackluster Earnings Report (12-Year Chart)

Reuters — Chipmaker Advanced Micro Devices Inc (AMD.O) reported lower-than-expected quarterly revenue in its business that supplies server chips, sending its shares down 8.3 percent in after-market trading on Monday.

Revenue in AMD’s business, which manufactures chips for the server industry and also gaming consoles, rose 5 percent to $391 million. However, that missed analysts’ average estimate of $442.1 million, according to financial data and analytics firm FactSet.

The miss overshadowed robust performance in the company’s computing and graphics business, driven by demand for its latest Ryzen processors and its graphics chips.

AMD also forecast second-quarter revenue to rise about 12 percent year-over-year at the midpoint.

Analysts on average were expecting revenue to rise about 9 percent to $1.12 billion, according to Thomson Reuters I/B/E/S.

The Sunnyvale, California-based company’s new Ryzen processors, aimed at the personal computer market, have helped rekindle its rivalry with Intel Corp (INTC.O), which has long dominated the industry.

AMD’s graphics processors, used in gaming consoles including Playstation 4 and Xbox One, have also gained a foothold in the low- to mid-range market for PC chips that are used to power video games. Rival Nvidia Corp (NVDA.O) has long controlled the high-end of the market.

AMD’s net loss narrowed to $73 million, or 8 cents per share, in the first quarter ended April 1, from $109 million, or 14 cents per share, a year earlier.

Revenue rose 18.3 percent to $984 million.

Excluding items, the company lost 4 cents per share.

The results were in-line with analysts’ estimates.

AMD’s shares, which joined the broader S&P 500 index (.SPX) in March, had risen more than 20 percent this year through Monday’s close, outperforming the 12 percent gain in the Philadelphia semiconductor index (.SOX).

AMD 12-Year Chart: