Two Stocks with Eye-Popping Growth Rates

Growth Stocks

Investors looking for growth stocks are concerned with a company’s future growth potential, but there is no absolute formula for evaluating this potential. Every method of picking growth stocks (or any other type of stock) requires some individual interpretation and judgment. Growth investors use certain methods ‐ or sets of guidelines or criteria ‐ as a framework for their analysis, but these methods must be applied with a company’s particular situation in mind. More specifically, the investor must consider the company in relation to its past performance and its industry’s performance. The application of any one guideline or criterion may therefore change from company to company and from industry to industry.

Using ChartScreen’s filter, input the following (adjusting as needed to fit current the current market):

- Return on Equity >= 20%

- P/E to Earnings Growth <= .5

- Earnings Growth (1yr) >=25%

- Revenue Growth (1yr) >=25%

- Market Capitalization < 5 Billion (Mid or Small)

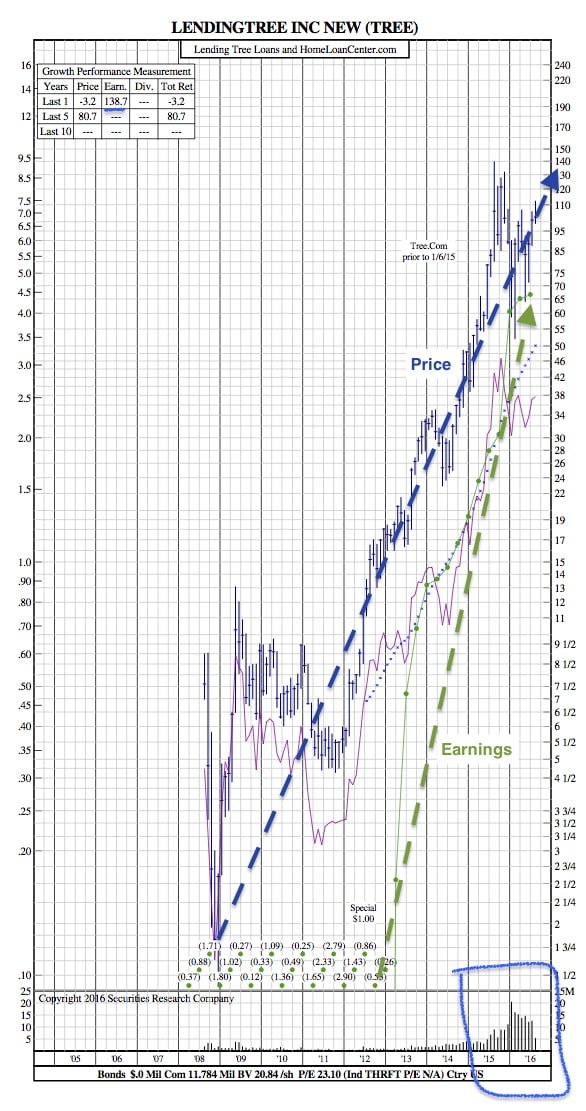

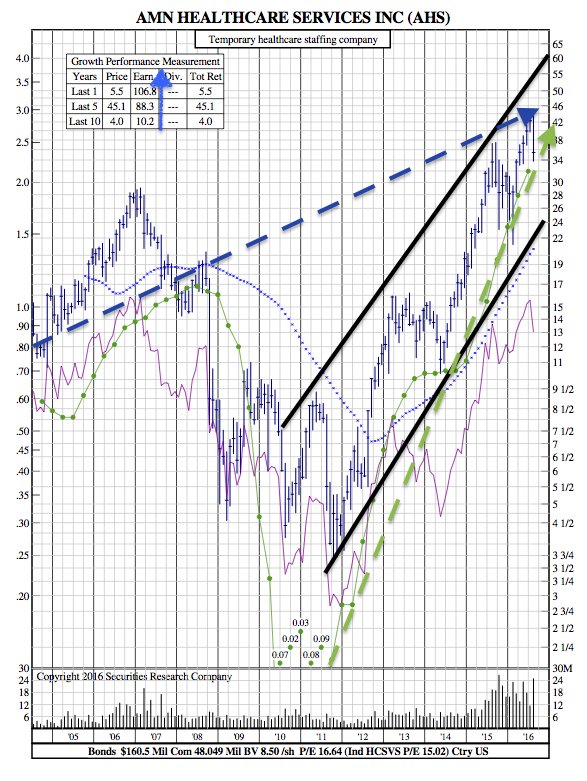

Two remarkable stocks that match these “growth parameters” are:

- Lending Tree ($TREE)

2. AMN Healthcare Services Inc. ($AHS)