Top 4 Dow Stocks for Retirement and Their 25-Year Charts

The Dow Jones Industrial Average consists of large, stable companies that pay dividends and represent some of the very best companies in their respective industries. That’s why a retiree (or someone planning for retirement) looking for a high-quality company with a dependable income stream, would be wise to look to the DJIA.

The Dow Jones Industrial Average consists of large, stable companies that pay dividends and represent some of the very best companies in their respective industries. That’s why a retiree (or someone planning for retirement) looking for a high-quality company with a dependable income stream, would be wise to look to the DJIA.

The DJIA consists of 30 stocks, so to pick a particular stock, one would need to focus on names with some combination of strong dividends, increasing profitability, and affordability in relation to future earnings potential — the following is four stocks that fit that very criterion.

Apple:

When thinking of a prototypical income stock, one doesn’t usually think of technology stocks right away. But Apple is no prototypical company — the tech giant pulled in $215.6 billion in sales and $45.7 billion in profits in the fiscal year that ended in September 2016—more revenues and earnings in a year than just about any other company in the world. Apple’s cash and securities stockpile has grown to $67.3 billion. The Cupertino, California-based company has another $170 billion in long-term investments. With all this cash, Apple has begun to reward shareholders in two ways: massive buybacks, which increases the per-share earnings of the shares that remain outstanding; & by hiking its dividend, which increased at an annualized pace of 10% over the past four years.

Apple might never achieve the growth rates it enjoyed when the iPhone was first ascendant. Profits, in fact, dipped 14.4% in fiscal 2016, compared with a year earlier. But analysts see earnings rising 9% in fiscal 2017 and 10% the following year, fueled by sales of a new iPhone that Apple will likely launch in late 2017 to coincide with its 10th anniversary on the market. Investors aren’t paying much for that growth, with the stock trading at about 13 times earnings, well below the P/E ratio of 17 for Standard & Poor’s 500-stock index. More dividend hikes are likely as Apple continues to rake in cash. (Bloomberg)

Merck:

Healthcare’s trusty Merck hasn’t missed a quarterly dividend payment in more than 30 years– and a recent 4-year streak of dividend increases is likely to continue. With years of acquisitions, research and development; Merck’s growth prospects are intriguing. A pipeline of successful drugs are now on the market (Merck has more potential winners in the works with 24 drugs in the latter stages of development), cancer medicine Keytruda is posting strong numbers. Analysts believe Merck’s earnings per share rose 5% in 2016. In the 12-month period that ended September 30, 2016, Merck generated $9 billion in free cash flow (cash profits, minus the capital expenditures needed to maintain the business).

Analysts believe Merck’s earnings per share rose 5% in 2016. In the 12-month period that ended September 30, 2016, Merck generated $9 billion in free cash flow. (Bloomberg)

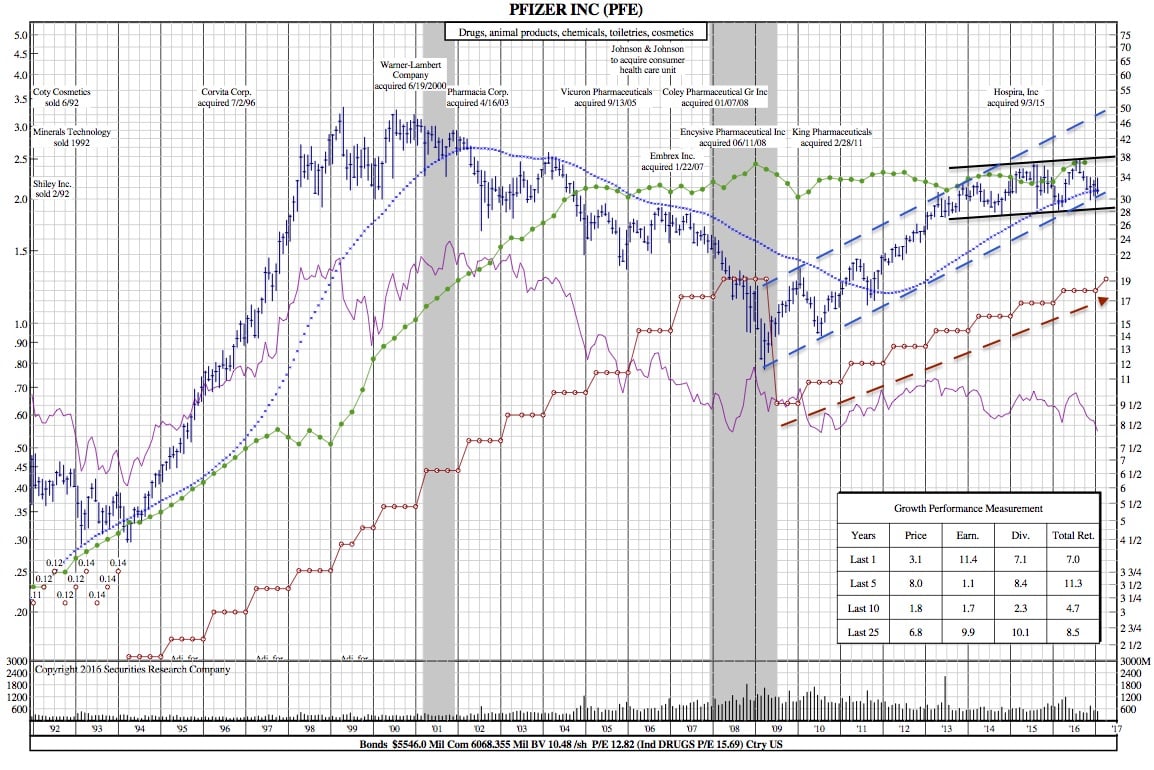

Pfizer:

Like Merck, Pfizer is a high-yield stock. However, one concern is that the company’s product pipeline can’t keep up and overcome the loss of revenues from drugs that lose patent protection. That being said, Pfizer has invested heavily in R&D and has made acquisitions to address the pipeline issue (there are currently 94 products planned to be released). Breast cancer treatment Ibrance, blood thinner Eliquis, and the pneumococcal pneumonia vaccine Prevnar 13; are just 3 of the company’s recent successes.

The company has paid quarterly dividends consistently for decades and has a six-year history of dividend growth. Earnings per share are expected to rise just 2% next year, but the dividend looks well-covered. Analysts forecast that the company will shell out more than $7 billion in dividends in 2017, less than half the firm’s estimated net income of $15.9 billion. (Bloomberg)

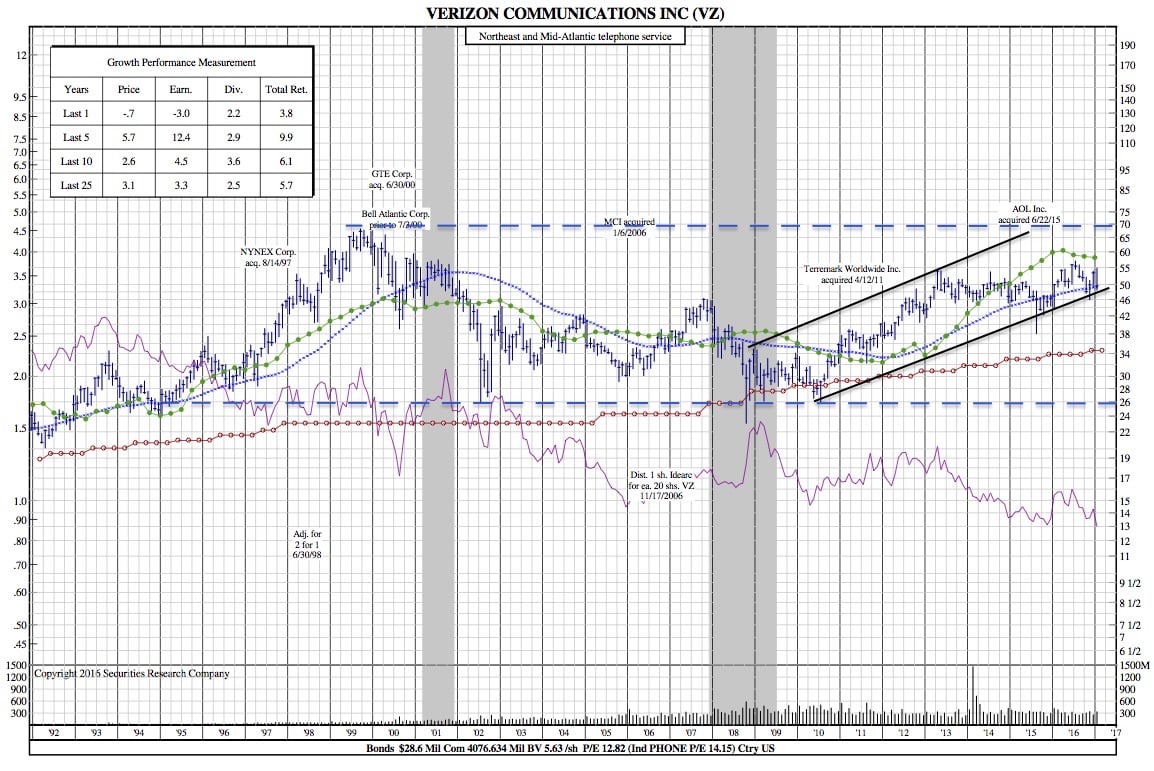

Verizon Communications:

Verizon Communications has 9 straight years of dividend growth.

Verizon is repositioning itself for a world where mobile content and ads are at every turn. The company purchased AOL for its digital-advertising technology in 2015 and currently has an agreement to buy Yahoo (although after two data breaches, there is a possibility the deal may fall through).

Verizon is generating revenue from multiple channels: mobile business, Fios TV service, and other sources. Profits could rise 4% in 2017, according to analysts. This 4% rise coupled with a 4.3% dividend yield, could result in total returns of more than 8% over the next year.