IBM Beats on Earnings, Reports Flat Sales (12-Year Chart Included)

International Business Machines Corp. ($IBM) shares fell late Monday after the company reported third-quarter earnings above Wall Street expectations but flat sales. IBM said it earned $2.85 billion, or $2.98 a share, in the quarter, compared with $2.95 billion in the third quarter of 2015. Adjusted for one-time items, IBM said it earned $3.29 a share in the quarter. Revenue reached $19.2 billion, flat compared to the year-ago quarter. Analysts polled by FactSet had expected IBM to report adjusted earnings of $3.23 a share on sales of $19 billion. IBM kept its 2016 expectations of adjusted earnings of at least $13.50 a share.

IBM continues to try to shift its business into growing areas such as artificial intelligence, cloud computing, data analytics and security as it reinvents the company.

Cloud revenue grew 2.4% to $8.75 billion during the quarter. Those services include SoftLayer, which sells access to computing capacity over the internet, and Bluemix, which, among other capabilities, sells access to software over the web. The cloud business during the quarter added new customers including Dixons Carphone Group, JFE Steel Co., Ltd. and Vodafone India. This year, IBM has bought 12 companies including Promontory Financial Group and Truven Health Analytics to spur growth in industry-specific businesses. The company has spent $5.45 billion during the first nine months of the year, compared with $821 million during the same period a year earlier. (MarketWatch)

“We’ll continue to run the business of consulting as we always do, but the consultants will help train and put the wisdom and knowledge of that understanding into Watson,” said Bridget van Kralingen, senior vice president of IBM Global Industry Platforms in an October 18 interview. This is similar to what IBM has done with Watson in the field of oncology, helping hospitals to better match cancer patients to clinical trials.

Acquisitions were expected to add an estimated $360 million to revenues during the quarter, compared with the year-earlier period, according to Toni Sacconaghi, an analyst at Bernstein Research.

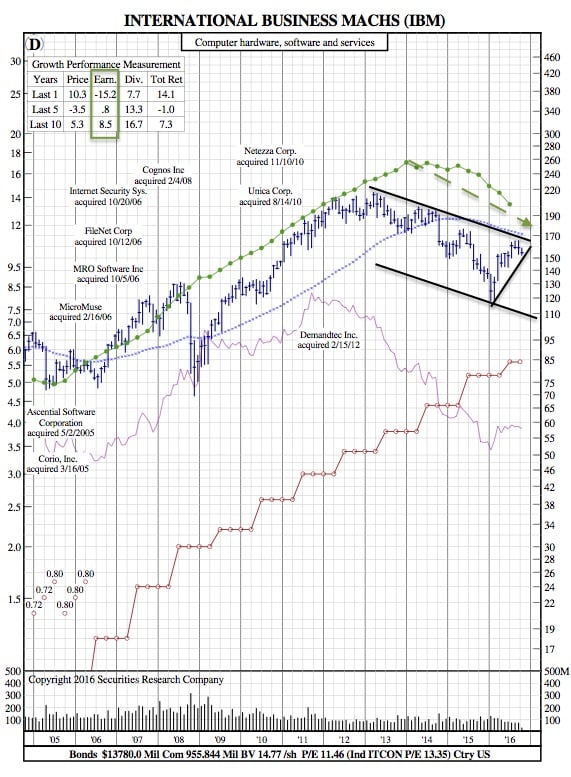

12-Year Chart:

Over the last year, IBMs earnings have fallen 15%. But because of a 10% growth in price and a 7.7% increase in dividends, investors have seen an overall return of 14.1%. With that being said, all metrics are trending down with price being the only outlier – this may spell trouble in the near future.