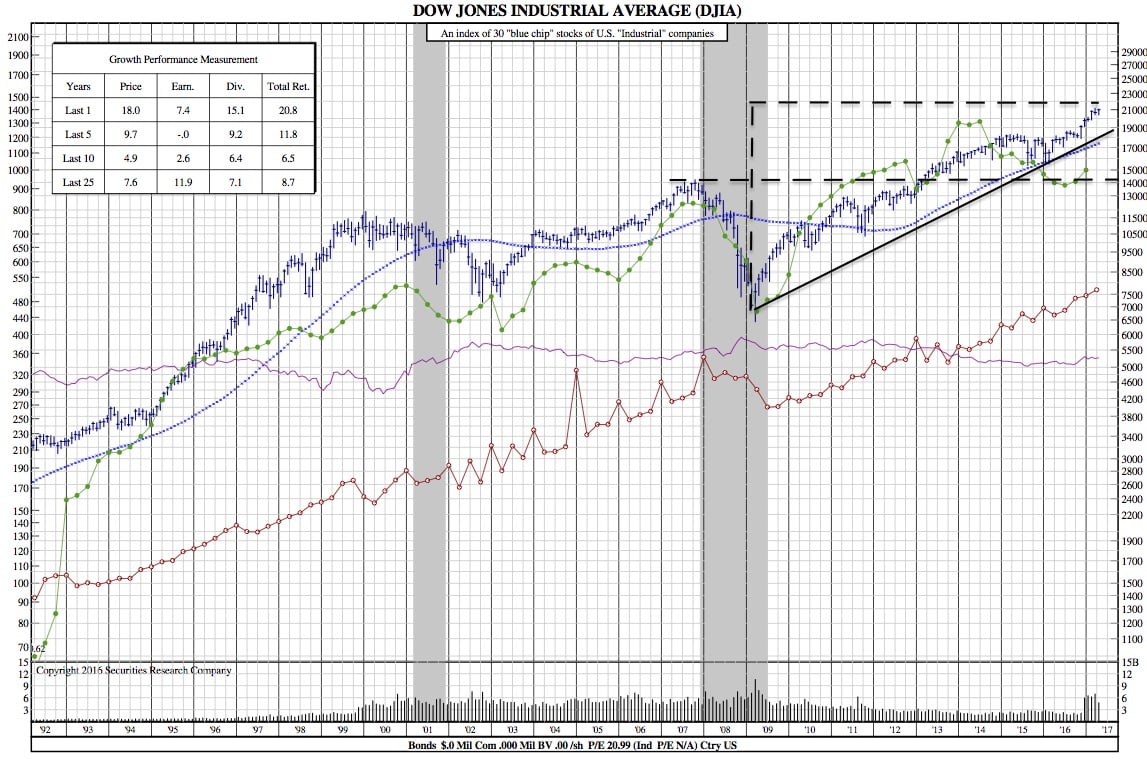

How Strong is the Current Bull Market and What can Stop it? (DJIA 25-Year Chart)

Yahoo Finance — Stock markets continue to hit new highs, even as new headlines out of Washington reflect what appears to be a profoundly dysfunctional White House.

“What could derail the markets? Probably nothing.”

That was the title of a recent note circulated by Greg Valliere, chief global strategist at Horizon Investments. The note was published hours before the Washington Post reported that President Donald Trump leaked classified information to the  Russian foreign minister and ambassador during a recent visit to the White House.

Russian foreign minister and ambassador during a recent visit to the White House.

“North Korea is getting closer to having an ICBM that could get close to Hawaii, with a scary payload; a U.S. preemptive strike is still on the table. And cyber security finally has emerged as a serious threat,” Valliere wrote. “Markets will have to worry about these issues, but they won’t significantly affect interest rates or earnings.”

What’s notable about the news out of the White House is that it makes it more difficult for Trump to advance his policy promises, which include tax reform. Nevertheless, Valliere sees a resilient market and he’s been communicating this message to clients for some time now.

“Make no mistake — tax reform is dead for this year,” Valliere said in an email last Wednesday. “But the fundamentals — moderate GDP growth, low inflation, low interest rates, good corporate earnings — will persist.”

Indeed, markets don’t really care about the endless drama of politics. They care about the fundamentals underlying the financial markets, which continue to be robust.

The all-time high market may still have room to rally

On Monday, the S&P 500 (^GSPC) closed at a record 2,402.

This rally has been accompanied by unusually low volatility, as reflected by the 10 handle on the CBOE Volatility Index (^VIX). Some warn that this low level of volatility is actually a sign of complacency and that it portends a spike in volatility. But not everyone.

“Yes, the VIX will surely not stay around 10 forever, but perhaps we would be better served to look past the worry over what unknown force will imminently bring the market down, and instead focus on the signals from a market that is moving up as economic fundamentals and earnings continue to grow,” Morgan Stanley’s Michael Wilson said on Monday.

Wilson expects the S&P 500 to hit 2,700 in a year.

“Navigating the markets is an inherently volatile endeavor and there will always be some storm clouds on the horizon, but the next market catalyst may well be the recognition that we are not in the eye of a storm, but have come out the other side, and that, at least for a while, the sailing looks smooth,” he added.

To be clear, there isn’t unanimous bullishness on Wall Street. On Friday, Goldman Sachs’ David Kostin warned clients that he expects the S&P to close the year at around 2,300, which means prices would have to fall 4%. Part of that call is driven by the expectation for higher labor costs to pressure profit margins.

For now, things are looking up.

DJIA 25-Year Chart: