Stock Market Terms

Stock market terms fall into two categories. This section focuses on the “need to know” stock market terms for the inexperienced and moderately experienced investor. The goal of this section is to provide stock market terms that will assist you in both fundamental and technical stock analysis and investment. For the experienced investor, there are many other stock market terms that that may not covered here.

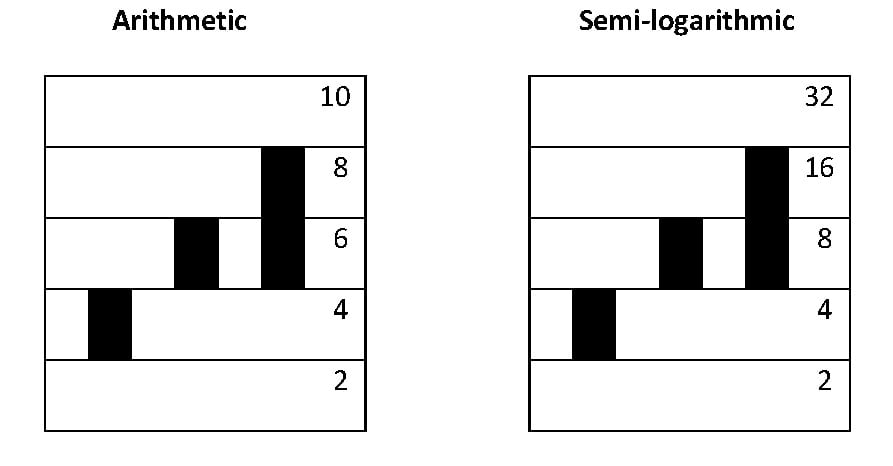

Scales. There are two kind of price scales used on stockcharts: arithmetic and semi-logarithmic (ratio). Arithmetic scales are easy – the chart grid is divided equally and each space is a fixed amount: a fraction of a point, one point, two points, five points. Semi-log scales have variable size spaces, each of which (whether a fraction, one two or more points) is sized in proportion to the price at each level.

Semi-logarithmic scale. The great advantage of such as scale is that every movement on a chart is in exact proportion to every other movement. This makes it possible to compare one company with another company because of the uniform ratio scale. That is impossible to do with arithmetic scales. To illustrate: if a stock moves from 2 to 4, it has appreciated two points or 100%. It it rises another two points from 4 to 6, the gain is only 50%. To gain another 100%, it would have to move from 4 to 8.

Even though the number of dollars or points may be greater at higher levels, the principle remains the same – the stock must move from 20 to 40 or from 200 to 400 to achieve a doubling, or 100% rise. This logarithmic scale is formulated so that any move of 100% (or any other percent) uses the same vertical linear distance on the chart, regardless of price level where it might occur.

Arithmetic scale. A move on an arithmetic scale from 2 to 4 looks exactly the same on such charts as a jump from 4 to 6, or even an edging up from 98 to 100. Obviously, a move of two points has much greater significance when a stock is selling at 2 than when it is selling at 8, but the arithmetic scale conceals this. When using an arithmetic scale rather than a semi-logarithmic scale, the extent of a price movement, large or small, is easily hidden, and comparisons of one stock with another on such a chart are difficult if not impossible to make – and may even be deceptive.

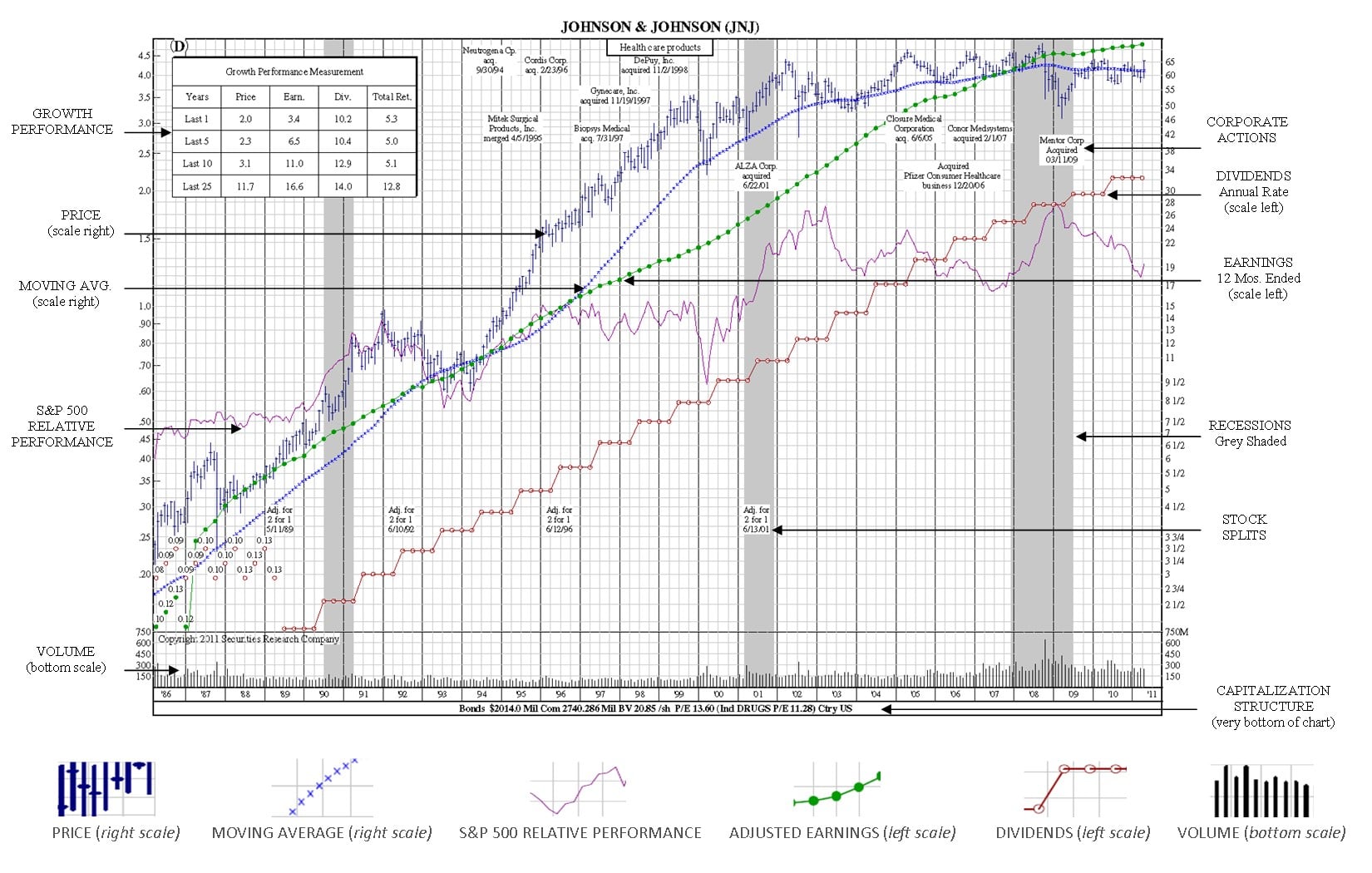

Relative Performance. The relative performance is used to graphically depict in an easy-to-read manner a stock’s performance relative to the widely used S&P 500. It shows how a stock is doing not in absolute terms, but how it is performing relative to the stock market as a whole as represented by the S&P 500. Thus, if a stock is doing better than the S&P 500 – its relative performance will go up. In fact, a stock could be declining – but at a slower rate than the market – and the relative performance line would be rising. If a stock is performing worse than the S&P 500 – either going up slower or declining fast, the relative performance line will head downward. Similarly if the stock performs about the same as the S&P 500, the relative performance will be horizontal.

Moving Average. One way of tuning out short-term gyrations from the chart of a stock’s price is the use a Moving Average. Each month this average is extended, it measures a different time period, as earlier months are dropped off and the latest month’s price is averaged in. This average is an essentially conservative measure, whose effect is to “damp out” wild price swings, seasonal variations, and other factors. Keep in mind, however, the it tends to diminish the effect of anything that happens quickly, no matter how important it might be.

One technical theory holds that the time to buy stock is when the stock price is above the moving average, dips towards it, but does not break through it, and then starts up again. In other words, if the moving average acts like a support level, watch carefully, it could be a buy signal.

Earnings Per Share. Earnings for Securities Research are adjusted for extraordinary items, such as sale or divestiture of real estate holdings or other effects on earnings which don’t pertain to the company’s core business. The exclusion of one-time events from earnings gives you the clearest picture of earnings performance – which is unique to SRC.

With SRC Charts, price and earnings are set by a ratio of 15:1. This means if price and earnings line meet, the P/E ratio is 15. If the earnings line is above the price line, then earnings is less than 15:1. If the earnings line is below the price line, then the earnings are greater than 15:1. Coincidently, if price and earnings are consistently increasing at the same rate the overall rate of growth can be easily defined at 15%. By consistently showing all of SRC’s charts this way, you can easily and efficiently compare literally hundreds of charts for price and earnings growth.

Earnings averages vary by industry – price/earnings ratios (P/E) which may be 10: 1 for one industry, and may be higher or lower for another – so it’s important to understand what the P/E ratio is for the industry the stock belongs to.

One main investing assumption holds that depending on the industry and company, earnings would fall to meet some future price or the price may rise to meet future earnings potential. For more information about earnings per share stock market terms, please go to this section.

Dividends. Dividend growth can give the chart user a very good idea of how the company is performing. Are dividends growing? Is there consistency to the dividend payments? How does dividend growth compare to price and earnings growth?

Dividend payments are displayed directly on SRC’s charts. Dividend payments, like earnings, are read from the left scale and are plotted on an annual basis. Dividends above or below the charts, as well as specials, extras, irregular payments are placed on labels.

As more investors nearing retirement years, the dividend a stock produces can significantly increase the overall return for a stock.

Stock Splits. Take, for example, a company with 100 shares of stock priced at $50 per share. The market capitalization is 100 × $50, or $5000. The company splits its stock 2-for-1. There are now 200 shares of stock and each shareholder holds twice as many shares. The price of each share is adjusted to $25. The market capitalization is 200 × $25 = $5000, the same as before the split.

Ratios of 2-for-1, 3-for-1, and 3-for-2 splits are the most common, but any ratio is possible. Splits of 4-for-3, 5-for-2, and 5-for-4 are used, though less frequently. Investors will sometimes receive cash payments in lieu of fractional shares.

It is often claimed that stock splits, in and of themselves, lead to higher stock prices; research, however, does not bear this out. What is true is that stock splits are usually initiated after a large run up in share price. Momentum investing would suggest that such a trend would continue regardless of the stock split. In any case, stock splits do increase the liquidity of a stock; there are more buyers and sellers for 10 shares at $10 than 1 share at $100.

Other effects could be psychological. If many investors believe that a stock split will result in an increased share price and purchase the stock the share price will tend to increase. Others contend that the management of a company, by initiating a stock split, is implicitly signaling its confidence in the future prospects of the company.

In a market where there is a high minimum number of shares, or a penalty for trading in so-called odd lots (a non multiple of some arbitrary number of shares), a reduced share price may attract more attention from small investors. Small investors such as these, however, will have negligible impact on the overall price.

Volume. Volume is crucial to interpreting price data. An extremely high or low price reached on very light volume may indicate the opinion of only small number of investors: possibly not good data. However, any price supported by massive buying or selling volume, conversely, can usually be taken seriously. Like heavy turnout in a presidential election, heavy volume is a mandate, and likely to indicate wide acceptance of the valuation of a stock. Volume on a stockchart is most often represented by height.

Corporate Actions. Important single events in a company’s history. These events could be an acquisition, merger or divestiture of another company or division, and can explain why there is a change in the price, earnings or dividend payments at a certain period in time.

The following stock market terms consist of ratios and calculations:

P/E Ratio. Calculation of the P/E ratio is derived from the last close price divided by the most recent reported (adjusted) earnings on a trailing twelve month basis.

P/B Ratio. The P/B ratio will be displayed with the selection of companies returned. Calculation of the P/B ratio is derived from the last close price divided by the most recent reported book value.

PEG/PEGY Ratio. The PEG Ratio will be displayed with the selection of companies returned. Calculation of the PEG Ratio is derived using the calculation of the most current P/E Ratio and dividing that by the Earnings Growth Percent for time period selected. These two values are calculated as described under the sections P/E Ratio and Earnings Growth.

Earnings Stability (R2). Earnings Stability measures the deviation of a company’s earnings from its historical earnings growth rate. A rate of 99 would indicate that the company’s earnings did not deviate at all from its historical earnings growth rate.

Compound Annual Growth Rate. (CAGR) is the rate of return is the growth from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each year of the stocks lifespan.

Dividend Yield. Calculation of the yield is derived from taking the latest annual dividend data by the most recent close price. Forward reported dividends are used if they are within 21 days of the calculation date. Only dividends reported on a consistent basis of monthly, quarterly, semi-annual, or an annual basis are taken into consideration.

Return on Equity. Calculation of the Return on Equity is derived from the companies net income divided by the companies shareholder equity from the latest reported statements.

Debt to Equity. Calculation of the Debt to Equity is derived from the companies total liabilities divided by the companies shareholder equity from the latest reported statements.

Price to Free Cash Flow Ratio. Calculation of the Price to Free Cash Flow Ratio is derived from the companies current market valuation divided by the companies free cash flow from the latest reported statements.

Market Capitalization. Market Capitalization described as Micro, Small, Mid, or Large Cap Stocks. The value returned for each company is in millions of dollars.

- Micro cap stocks are under $250 million.

- Small cap stocks are equal to or greater than $250 million to $1 billion.

- Mid cap stocks are greater than $1 billion to $5 billion.

- Large cap stocks are greater than $5 billion.

Stock market terms relating to growth rates:

Price Growth. Calculation of the price growth percent is derived using the last close price and the corresponding month end value for the current value being calculated in the time period of your selection. These values are then used to calculate the compound annual growth rate (CAGR) which is then multiplied by 100 to create a percent value.

Earnings Growth. Calculation of the earnings growth percent is derived using the last reported (adjusted) earnings on a trailing twelve month basis maintained on our system and the closest corresponding quarterly value for the current value being calculated in the time period of your selection. These values are then used to calculate the compound annual growth rate (CAGR) which is then multiplied by 100 to create a percent value.

Dividend Growth. Calculation of the dividend growth percent is derived using the annualized dividend reported closest to the date of calculation but not exceeding it maintained on our system and the closest corresponding value for the current value being calculated in the time period of your selection. Only ordinary dividends are used for these values. These values are then used to calculate the compound annual growth rate (CAGR) which is then multiplied by 100 to create a percent value.

Revenue Growth. Calculation of the revenue growth percent is derived using the last reported revenue on a four quarter rolling sum and the closest corresponding quarterly value for the current value being calculated in the time period of your selection. These values are then used to calculate the compound annual growth rate (CAGR) which is then multiplied by 100 to create a percent value.

Stock Market Terms: SRC Stockchart Example

We hope these stock market terms are helpful to you. To learn more about how to apply these stock market terms in stock selection, please continue to the next section: Earnings Per Share which goes into much great depth about the importance of earnings in you decision making.